Emory University has revealed it holds over $15 million in Grayscale Bitcoin Mini Trust (GBTC) shares, making it the first collegiate endowment to invest in a Bitcoin ETF.

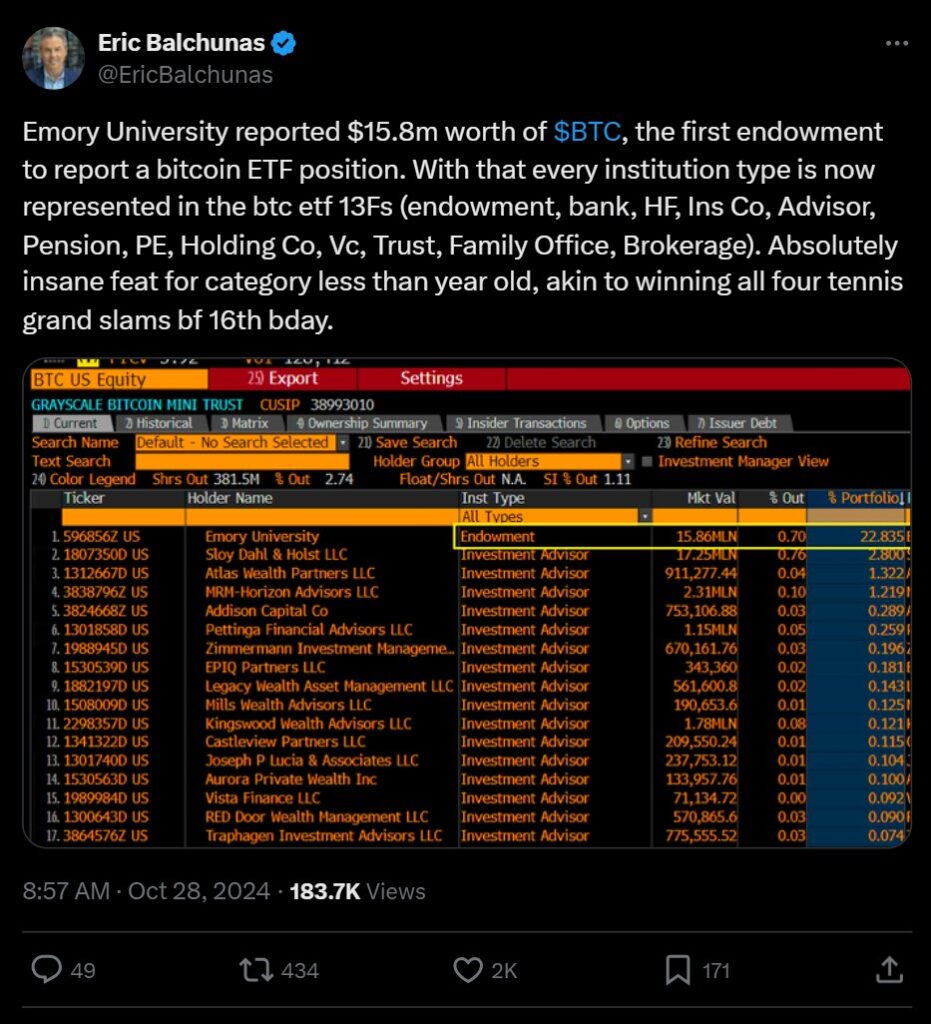

Emory University has accumulated Bitcoin ETF shares worth more than $15 million, according to a regulatory filing on October 25th. Eric Balchunas, an analyst for Bloomberg ETFs, stated in an article on the X platform on October 28th that Emory University is the first collegiate endowment to declare holding shares in a Bitcoin ETF.

The statement reveals that Emory owned nearly 2.7 million shares of Grayscale Bitcoin Mini Trust (GBTC), valued at nearly $15.1 million, at the time of filing. In reference to the public disclosures that large US investment managers are required to publish on a quarterly basis, Balchunas stated, “With that, every institution type is now represented in the Bitcoin ETF 13Fs.”

This includes endowment funds, banks, hedge funds, insurance companies, advisors, pension funds, private equity firms, holding companies, trusts, family offices, and brokerage firms.

Bitcoin exchange-traded funds (ETFs) came into existence in January, which contributed to the legitimization of Bitcoin as an asset class and sparked broad acceptance among institutional investors.

The State of Michigan Retirement System disclosed investments in a spot Bitcoin exchange-traded fund (ETF) that ARK 21Shares marketed. During the time that the application was submitted, the value of the shares was approximately $6.6 million, which is a relatively modest proportion of the billions of dollars that the fund possessed in assets.

Nate Geraci, president of The ETF Store and an investment consultant, posted on the X platform that cryptocurrency funds launched thirteen of the twenty-five largest exchange-traded funds in 2024 based on fund inflows through the month of August.

According to a post that Geraci made on X, Bitcoin has effectively dominated the exchange-traded fund (ETF) landscape this year, accounting for six of the top ten most successful launches in 2024.

The month of July saw the introduction of multiple Ether exchange-traded funds (ETFs), which have since attracted net inflows totaling more than one billion dollars. At this time, issuers are striving to establish exchange-traded funds (ETFs) for other tokens, such as Solana and XRP.

Cboe, a securities exchange, submitted a request to regulators in July, requesting approval to list the SOL exchange-traded funds created by VanEck and 21Shares.Canary Capital and Bitwise, both of which are ETF issuers, submitted their proposals for XRP exchange-traded funds in the month of October.