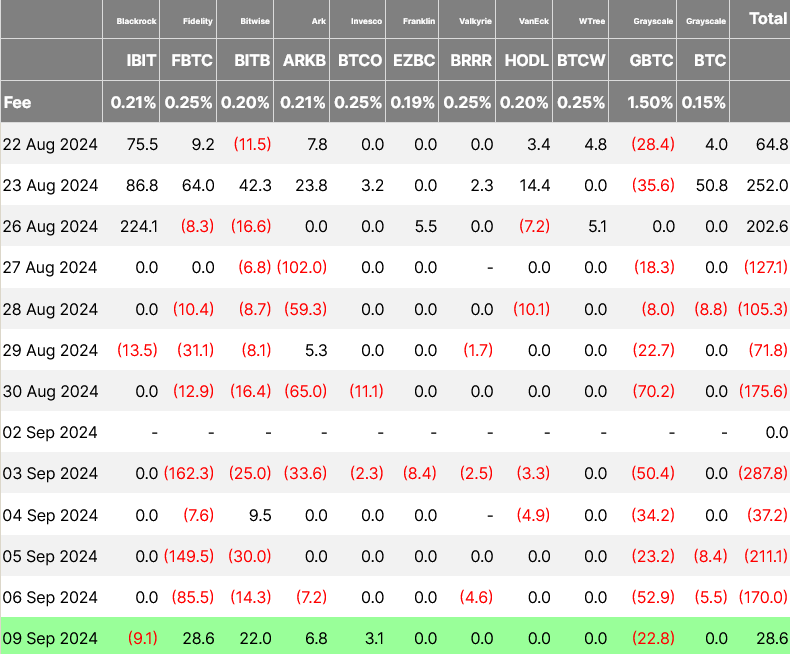

On September 9, the US spot Bitcoin exchange-traded funds (ETFs) experienced a net inflow of $28.6 million, deviating from the 8-day streak of outflows.

BlackRock’s iShares Bitcoin Trust (IBIT) experienced its third-ever day of net outflows totaling $9.1 million. This is the smallest outflow on record, with the largest being $36.9 million on May 1 and $13.5 million on August 29, according to data from Farside Investors.

The Bitwise Bitcoin ETF (BITB) and ARK 21Shares Bitcoin ETF (ARKB) experienced inflows of $22 million and $6.8 million, respectively.

In comparison, the Fidelity Wise Origin Bitcoin Fund (FBTC) experienced the most significant inflow of $28.6 million on the day.

The Invesco Galaxy Bitcoin ETF (BTCO) also experienced a $3.1 million inflow.

Before the eight-day outflow trend ended on September 9, approximately $1.2 billion fled the spot Bitcoin ETFs during the trading days between August 27 and September 6.

CoinGecko data indicates that it occurred after a 5.35% Bitcoin rally that culminated in a high of $57,635 on September 9 before declining to $56,682 at current prices.

BlackRock remains the top-rank Bitcoin ETF issuer, with a total net inflow of $20.9 billion. Fidelity and ARK 21Shares complete the top three, with $9.45 billion and $2.28 billion, respectively.

The total net inflows across all platforms total $16.93 billion, with the Grayscale Bitcoin Trust (GBTC) accounting for over $20 billion in outflows.

Ethereum exchange-traded funds (ETFs) see Outflow

On September 9, the spot Ether ETFs issued in the United States experienced a $5.2 million outflow, the seventh trading day without an inflow.

Like the spot Bitcoin ETFs, BlackRock, and Fidelity’s Ether products dominated the market with inflows of $1 billion and $405.4 million, respectively.

The Grayscale Ethereum Trust (ETHE) has experienced $2.69 billion in disbursements, while Bitwise’s fund ranked third with $315.9 million.