DeFi, also known as decentralized finance and all you need to know about it is explained in this article. It is a perfect guide for a beginner seeking answers about DeFi and all it is about.

Following the debut of Bitcoin in 2009, a thriving industry grew up around the asset, its concept, and its underlying technology.

Different niches exist in the crypto and blockchain ecosystem, where projects and businesses build solutions for distinct use cases.

Decentralized finance (DeFi), which was formed as an alternative to traditional financial services, is one such speciality.

DeFi, in particular, is made up of smart contracts that power decentralized applications (DApps) and protocols. Many of the first DeFi applications were built on Ethereum, and Ethereum still holds the majority of the ecosystem’s total value locked (TVL).

Bitcoin (BTC) has properties that are considered as foundations of decentralization at its core. DeFi, on the other hand, builds on such qualities by introducing new capabilities.

What exactly is DeFi?

DeFi is a subgroup of the broader crypto sector that provides many of the conventional financial world’s services in a way that is managed by the people rather than a central body or entities.

Although lending started it all, DeFi applications today include a wide range of functions, including saving, investing, trading, market-making, and more.

The ultimate goal of decentralized finance is to challenge and eventually replace established financial service providers.

DeFi frequently makes use of open-source code, allowing anyone to develop on top of pre-existing apps in a permissionless, modular manner.

The term “finance” is simple to grasp, but what exactly is “decentralization?” ” To put it another way, decentralization means that no single authority has power over something.

Banks and other financial institutions have some control over your money. These organizations have the ability to freeze your funds, and you are at the mercy of their operating hours and cash reserves.

Decentralization in DeFi entails not only a distribution of power but also a distribution of risk. For example, if a corporation stores all of its client data in one location, a hacker only has to gain access to one site to gain access to a large amount of information. Storing the data in several locations or removing that single point of failure, on the other hand, could improve security.

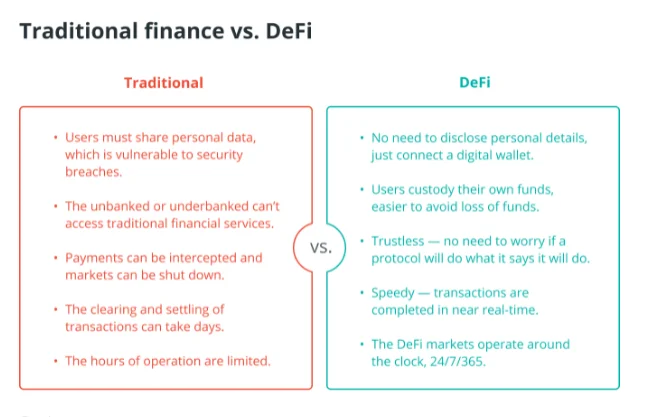

Traditional finance vs. DeFi

Commercial banks will be used as an example in this comparison. You can utilize financial institutions to keep your money, borrow money, earn interest, send transactions, and so on in the traditional world.

Commercial banks have a long and successful track record. Commercial banks can provide insurance and put in place security measures to deter and prevent theft.

Such institutions, on the other hand, hold and control your assets to some extent. You’re limited by banking hours for certain tasks, and transactions might be time-consuming, necessitating back-end settlement.

Commercial banks also require specific customer information and identification documents in order to participate.

DeFi is a market category that consists of financial products and services that are available to anybody with an internet connection and operate independently of banks or other third-party corporations.

Because the decentralized financial market never sleeps, transactions take place in near real-time 24 hours a day, seven days a week, with no one to halt them.

You may save your cryptocurrency on PCs, hardware wallets, and other devices, and access it at any time.

The fundamental technology that underpins Bitcoin and most other cryptocurrencies has these properties. Transactions are done faster, cheaper, and — in certain situations — more securely with DeFi’s reliance on blockchain technology than they would be with human interaction.

Decentralized finance aims to overcome a slew of problems that plague traditional financial systems by employing cryptographic technologies.

Overall, DeFi allows users to access borrowing and lending markets, trade long and short cryptocurrencies, and make profits through yield farming, among other things.

Decentralized finance has the potential to be a game-changer for the world’s 2 billion unbanked individuals, who, for various reasons, lack access to traditional financial services.

DeFi solutions are based on a variety of blockchains, with ecosystems made up of members engaging in a peer-to-peer (P2P) manner, aided by distributed ledger technology and smart contracts that keep the systems in check.

Such outcomes are not constrained by geographical boundaries, and participation does not necessitate identification paperwork.

This financial system’s architecture operates according to pre-programmed rules. You would transmit amounts of a certain cryptocurrency to a secure digital location – a smart contract — as collateral for your loan, receiving a different asset in return, rather than via an intermediary such as a bank. Your collateral assets would then be held in escrow until you paid back the loan.

Though you may or may not engage in a P2P manner when using DeFi solutions, the essence of the procedure is P2P in that third parties are substituted by technology that is not governed by a central authority.

What exactly is DeFi?

DeFi exploded in popularity in 2020, attracting a slew of new enterprises and popularizing a new financial trend. Because Bitcoin has numerous DeFi traits, there is no definitive start date for the DeFi sector other than Bitcoin’s introduction in 2009.

Following 2017, however, a number of ecosystems grew in popularity, including Compound Finance and MakerDAO, which popularized new financial possibilities for crypto and DeFi.

In 2020, the DeFi market exploded as more platforms emerged in response to people using DeFi solutions for techniques like yield farming.

Exchanges that are not centralized (DEXs)

DEXs allow consumers to exchange digital assets without the assistance of an intermediary or third-party service provider in a noncustodial manner.

DEXs have been a part of the overall crypto business for years while being only one component of the DeFi sector. They allow users to purchase and sell digital money without having to open an account with an exchange.

DEXs allow you to store assets outside of a centralized platform while still allowing you to trade at will from your wallets via blockchain transactions.

Automated market makers, a sort of DEX, became popular in 2020, and they use smart contracts and liquidity pools to make buying and selling crypto assets easier.

DEXs are often constructed on top of different blockchains, limiting their compatibility to the technology they are based on. DEXs built on Ethereum‘s blockchain, for example, make it easier to trade Ethereum-based assets like ERC-20 tokens.

Using DEXs necessitates the use of wallets that are interoperable with DEXs. Self-custody crypto wallets, in general, provide you with complete control over your assets, and some of them are compatible with DEXs.

This sort of asset storage, on the other hand, places greater responsibility on you for the safety of your funds. Furthermore, some DEXs may offer fewer services and charge higher fees than centralized exchanges.

DEXs have come a long way in terms of liquidity and user base, both of which are still growing. Trading volumes are projected to rise even more as DEXs become more scalable — that is, faster and more efficient.

Wallets and aggregators

The interfaces via which consumers interact with the DeFi market are known as aggregators. They are, at their most basic level, decentralized asset management systems that automatically shift customers’ crypto assets across several yield-farming platforms to maximize returns.

Wallets are places where digital assets are stored and traded. Wallets can hold a variety of assets or just one, and they exist in a variety of formats, such as software, hardware, and exchange wallets.

Self-hosted wallets, or wallets in which you handle your own private keys, can be an important part of DeFi, facilitating a variety of DeFi platform uses depending on the wallet.

Exchange-based wallets, on the other hand, manage your private keys for you, providing you less control but also lowering your security risk.

Markets that are not centralized

A core use case for blockchain technology is decentralized markets. They put the “peer” in peer-to-peer networks by allowing users to deal with one another in an untrustworthy manner — that is, without the need for a middleman.

Ethereum is the most popular smart contract platform for decentralized marketplaces, but there are numerous others that allow users to sell or exchange certain assets, such as nonfungible tokens (NFTs).

Markets for oracles/predictions

Oracles use a third-party supplier to bring real-world off-chain data to the blockchain. Oracles opened the way for prediction markets on DeFi crypto platforms, where users may wager on the result of events ranging from elections to price movements, with payouts delivered through a smart contract-governed automated procedure.

one layer

The first layer symbolizes the blockchain on which the developers intend to build. It’s where the DeFi apps and protocols are installed.

As previously said, Ethereum is the most widely used layer-one solution in decentralized finance, although there are competitors such as Polkadot, Binance Smart Chain, Tezos, Solana, and Cosmos.

As the DeFi space evolves, these solutions will eventually interact with one another.

There are several advantages to having DeFi sector solutions run on separate blockchains. Based on the performance of rival blockchains, blockchains may be compelled to improve speed and cut costs, creating a competitive environment that could lead to enhanced functionality.

Instead of everyone trying to cram onto a single layer-one choice, the existence of multiple layer-one blockchains allows for more development and traffic.

Case studies

It is beneficial to investigate the use cases of DeFi in order to answer the question “What is DeFi?” There are new ways to satisfy those requirements, whether you want to lend or borrow, trade on DEXs, stake your digital assets, or do anything else — even gaming. The following is a list of some of the most common applications for decentralized finance.

Platforms for lending

Borrowing and lending have become some of the most popular DeFi activities. Lending protocols allow users to borrow money while putting their own coin up as security.

Massive quantities of capital have flowed through the decentralized finance ecosystem, with lending solutions commanding billions of dollars in total value locked, or TVL – the amount of capital kept locked in any solution at any given time.

Stablecoins and payments

There must be a stable unit of account, or asset, for DeFi to qualify as a financial system that includes transactions and contracts.

Participants must be able to anticipate that the value of the asset they are using will not plummet. Stablecoins come into play here.

Stablecoins provide stability to operations like lending and borrowing that are widespread in the DeFi market.

Because stablecoins are anchored to a fiat currency, such as the US dollar or the euro, they don’t have nearly the same level of volatility as cryptocurrencies and are thus more suitable for trade and trading.

Leverage and margin

The margin and leverage components advance the decentralized finance market by allowing users to borrow cryptocurrencies on margin and utilize other cryptocurrencies as collateral.

Furthermore, smart contracts can be configured to contain leverage, which might potentially increase the user’s profits. The usage of these DeFi components also raises the user’s risk exposure, especially as the system is dependent on algorithms with no human component in the event of a malfunction.

Activities that are DeFi-native

For many decentralized exchanges, liquidity pools are an essential tool for facilitating trading. Buyers and sellers pay a charge for their transactions, and they use them to offer trading liquidity.

Liquidity providers can join a pool by sending funds to a smart contract and receiving pool tokens in exchange, generating a passive profit from the fees traders pay when interacting with that pool. To obtain your deposited funds back, you’ll need pool tokens.

Yield farming, also known as liquidity mining, is another activity in the DeFi environment that entails looking for a profit through various DeFi initiatives by engaging in liquidity pools.

While yield farming has its complexities, there is one major reason why market participants are attracted to it: It allows you to invest your cryptocurrency holdings in order to earn additional cryptocurrency.

Users that engage in yield farming lend their crypto to other users in exchange for interest, which is paid in crypto — usually “governance tokens” that offer liquidity providers a say in the protocol’s functioning.

It is a crucial innovation in the DeFi sector, allowing investors to put their crypto to work to increase returns. Yield farming has been termed the “Wild West” of DeFi, with traders scouring the market for the finest tactics, which they then keep close to the vest so as not to reveal their secrets to other traders and lose the enchantment.

What are the dangers of DeFi?

Despite its potential, the decentralized finance area is still a developing market with significant growing pains.

DeFi has yet to achieve widespread adoption, and to do so, blockchains must become more scalable. Blockchain infrastructure is still in its infancy, with much of it proving difficult to utilize for both developers and market participants.

Transactions on some systems move slowly, and this will continue until scalability increases, which is the motivation behind the creation of Ethereum 2.0, also known as Eth2. Fiat on-ramps to DeFi platforms can also be extremely slow, putting user adoption at risk.

DeFi’s popularity has skyrocketed. Given its young and ingenuity, the legal nuances surrounding DeFi are likely still being ironed out.

Governments around the world may try to incorporate DeFi into their existing regulatory frameworks, or they may create new rules specifically for the industry. DeFi, on the other hand, may already be subject to special rules.

It’s unclear how things will turn out in the future in terms of adoption. Traditional finance may absorb components of DeFi while preserving elements of centralization, rather than DeFi entirely displacing mainstream financial options, as one possible conclusion.

However, completely decentralized alternatives may continue to exist outside of mainstream finance.