On February 21, numerous crypto tokens and traditional securities powered by artificial intelligence (AI) experienced favorable growth despite a more extensive market downturn.

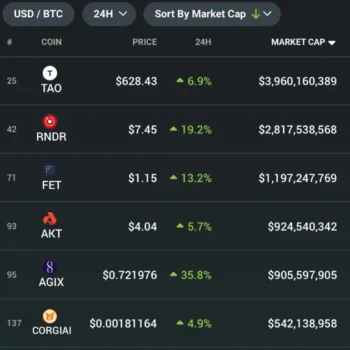

Prominent AI-based cryptocurrency tokens experienced double-digit growth in value after their market capitalization doubled in a month.

In the preceding twenty-four hours, Render (RNDR), an Ethereum-based network that enables decentralized GPU rendering, has increased by more than 17%.

Similarly, the utilization of The Graph (GRT), an indexing protocol designed to facilitate efficient queries of blockchain data, has witnessed a growth of 18% within the last twenty-four hours. Daily gains for Fetch.AI (FET) and SingularityNet (AGIX) are 11% and 33%, respectively.

Since Nvidia’s quarterly earnings report, the valuation of AI-based tokens has increased by more than 9 percent to $17.8 billion. This month, the market capitalization of AI tokens increased from $7 billion to $17 billion.

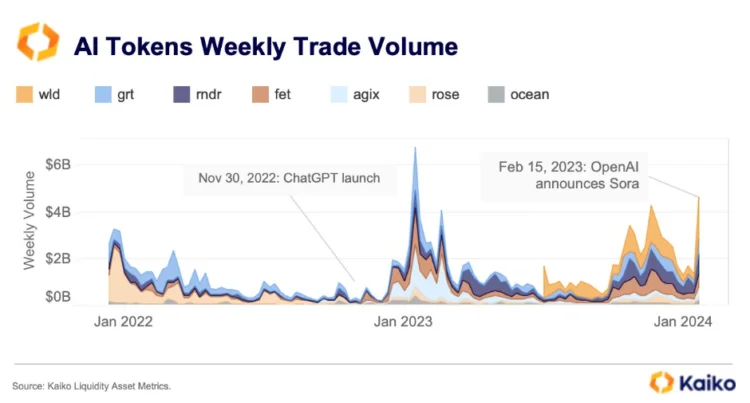

Nvidia’s recent earnings report provided a boost to the AI tokens. Still, momentum for AI-related tokens has been increasing since last week, when OpenAI unveiled its text-to-video tool Sora, and the weekly trade volume reached its most significant level in a year.

Numerous individuals ascribed the positive market expansion of AI tokens to Nvidia’s most recent earnings report for the fourth quarter, which exceeded market expectations.

The semiconductor manufacturer reported $22.1 billion in revenue, more significant than the $20.4 billion forecast by Wall Street. Revenue from Nvidia’s AI data centers increased by a factor of five during the January quarter of 2018 compared to last year.

Jensen Huang, the chief executive officer of Nvidia, attributed the increase in revenue and sales to the burgeoning global demand for generative AI. With a market capitalization of $1.67 trillion, the chipmaker has surpassed Tesla as the most actively traded stock in the world.

The surge in Nvidia’s AI operations positively impacted the AI cryptocurrency market, causing a number of AI-focused equities to reach all-time highs. During morning trading on February 21, Taiwan Semiconductor Manufacturing Company (TSMC), a significant contract chipmaker and Nvidia supplier, surged as high as 2.05%.

Similarly, during after-hours trading on February 20, shares of server component supplier Super Micro Computer rose 11.42 percent. ASML, a Dutch semiconductor equipment manufacturer, increased 2.7% in after-hours trading.