CFTC court filing outlines a murky relationship between FTX and Alameda Research, highlighting the latter’s unfair trading advantage.

The shady partnership between FTX and Alameda Research, in which the hedge fund was given a “unfair” trading advantage and unheard-of access to user holdings on the cryptocurrency exchange, is still coming to light in court documents.

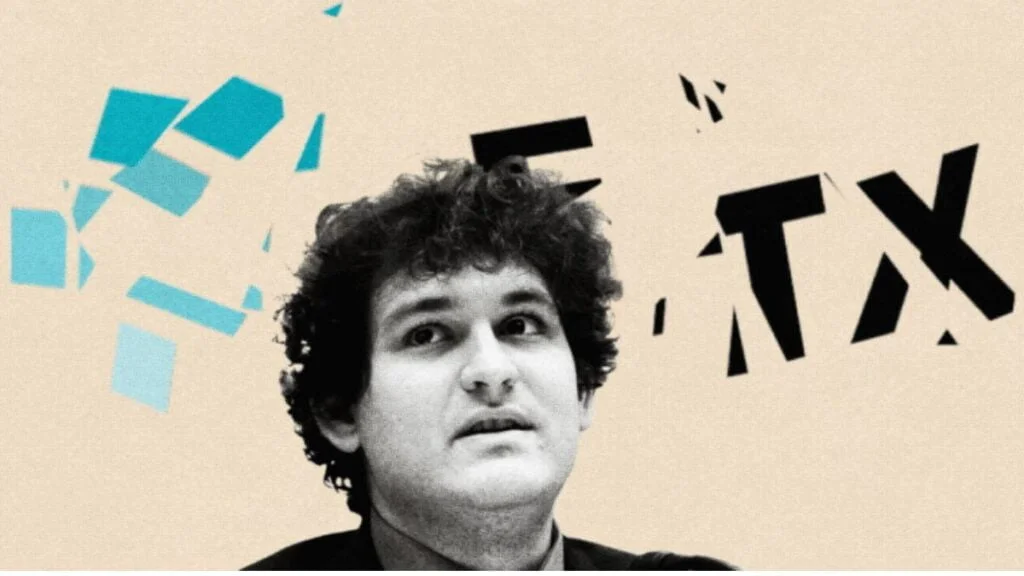

In a complaint submitted on December 1 to the Southern District Court in New York, the United States Commodities Futures Trading Commission alleged a number of improper business interactions between Sam Bankman-Fried’s exchange FTX and his trading firm Alameda Research.

The complaint makes a number of claims that the two businesses and a few individuals, notably Bankman-Fried, broke the Commodity Exchange Act and other laws.

The former CEO was detained in the Bahamas on December 12 and is expected to be extradited to the US as a result of this.The CFTC describes how, between May 2019 until their collapse in November 2022, Bankman-Fried owned and operated FTX.com and its affiliated subsidiaries as well as Alameda and its related businesses.

On FTX.com, Alameda served as a key market maker, giving its cryptocurrency markets liquidity. The businesses engaged in “common enterprise” operations, but according to the CFTC, this was exploited in a number of ways.

FTX customers’ deposits, including fiat money, Bitcoin ($18,033), and Ether ($1,316), were allegedly “accepted, held by, and/or appropriated by Alameda” for its own use.

This was done, according to the filing, with the help of a small group of insiders. Additionally, according to the CFTC, FTX administrators added capabilities to the exchange’s code that let “Alameda to maintain an essentially unlimitless line of credit on FTX.”

Alameda was given additional exemptions that gave it “an unfair edge” when trading on FTX. Faster trading execution times and an exclusion from the exchange’s “distinctive auto-liquidation risk management process” were included in this.

FTX and user funds were reportedly used by Bankman-Fried and another Alameda executive to fund a “range of high-risk digital asset industry investments” as well as to trade on external cryptocurrency exchanges.

Additionally, Bankman-Fried and other FTX executives obtained shoddy-documented “loans” from Alameda totaling hundreds of millions of dollars. These funds were utilized to support political contributions as well as the purchase of opulent real estate and property.

While FTX Trading asserted in its terms of service that customers owned and maintained control of the assets in their accounts and that these were protected and kept separate from FTX’s finances, there was widespread misappropriation of consumer cash.