On February 7, Alameda-linked wallets started to function once again, sending FTT tokens worth about $2.3 million.

The Alameda wallet activity after the bankruptcy of FTX has raised a lot of questions in the crypto world about the legitimacy of law enforcement and how these wallets are being accessed.

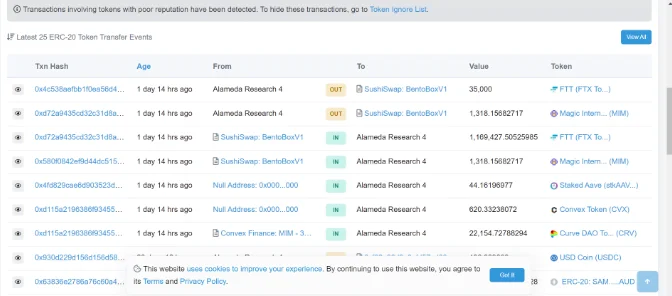

Nearly $2 million worth of FTT tokens were moved from the BentoBox smart contract on Sushiswap to the Alameda address “brokenfish.eth.” The primary vault for the whole Sushi ecosystem is the in question smart contract. Sam Bankman-Fried, the former CEO of FTX, took over the Sushiswap protocol from Chef Nomi, a previous top developer, in 2020.

More than 1 million FTT, or nearly $2.3 million, were purchased using an Alameda Research 4 wallet between $1.86 and $1.87. They’ve only seen them transfer 35,000 FTT to the Abracadabra farm output; they haven’t seen them remove money from their wallets. Additionally, the wallet created a loan position on Abracadabra that is now secured by a mortgage of $73,000 FTT and $31,000.

Many people connected the transfer of cash to the current bankruptcy proceedings and thought John Ray III, the court-appointed CEO of FTX, had approved the transfers of funds.

The exchange’s obligations must be paid off, and Ray III has made no secret of his ambition to take control of the assets of the exchange and its subsidiaries. On January 17, FTX said that throughout its investigations, it had found over $5.5 billion in liquid assets, with more than $3 billion owed to its top 50 debtors.

Alameda-linked wallets have seen money transfers before; initially, on February 2, blockchain security company PeckShield notified that “Alameda Consolidation” had received $13 million in cryptocurrency from three separate wallets.

The owner of the first is Bitfinex, the largest Bitcoin exchange in the world. It transferred around $8.5 million in the form of 6 million Tether USDT and 1,545 ether. About $6 million in USD Coin was transmitted by the other unnamed parties to the Alameda Consolidation address.