Significant algo trading resulted from the drying inflows into spot Bitcoin ETFs, which caused substantial BTC price volatility in Asian markets.

Asia’s Bitcoin investors have been subjected to significant volatility as a result of the effects of automated trading protocols that respond to flows in US Bitcoin ETFs.

Updates on the demand for spot Bitcoin ETFs circulate daily through the crypto market during Asian trading hours, following the close of US share trading.

As a result of data indicating investors were withdrawing funds, Bitcoin and the broader cryptocurrency market suffered their largest monthly decline during the Asian morning session on Tuesday.

Principal trading firm Arbelos Markets’ president, Shiliang Tang, said:

“From an algorithmic trading perspective, bots can basically auto-scrape this data and buy and sell based on this. It seems that’s basically what is happening.”

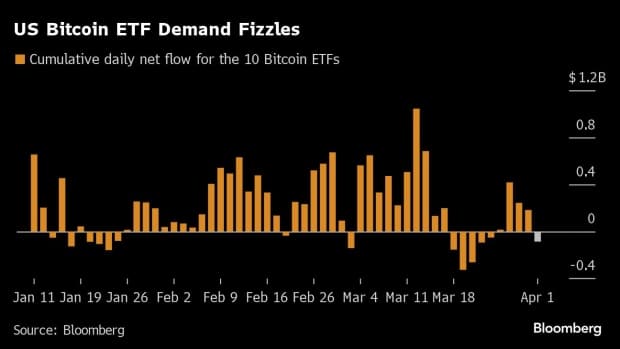

Bitcoin ETF Inflows Decrease

Conversely, the Bitcoin ETF market has also encountered periods of instability in recent times.

During the first two weeks of March, inflows peaked, which coincided with Bitcoin’s ascent to a record high of $73,798.

However, after its historical zenith, the sector has encountered intermittent periods of outflows, resulting in an approximate 11% decrease in the value of the token.

Charlie Morris, Chief Investment Officer of ByteTree Asset Management, stated that the broader ETF market holds around 5.5% of Bitcoin, compared to gold’s 1% allocation.

This, according to Morris, renders Bitcoin ETF flows more influential than gold ETF flows.

Additionally, Tang observed that this flow pattern clarifies the fluctuating market returns that occur during Asian trading hours.

February and early March witnessed a discernible surge in strength, which was succeeded by a tumultuous descent in late March.

Furthermore, algorithmic protocols offloading BTC contributed to the liquidation of bullish crypto speculations totaling approximately $354 million on Tuesday, according to Coinglass data.

The derivatives market may experience cascading effects as a result of this activity.

Meanwhile, Tuesday saw the Bitcoin price plummet by more than 6%, falling to $65,400.

The sector is anxiously anticipating the upcoming Bitcoin halving, a development that has the potential to cause a significant disruption in supply and propel prices upward.