Pseudonymous analyst Petruschki provided data from the Bloomberg Terminal that showed the insurance giant had invested in four different sub-organizations.

Germany’s largest insurance company, Allianz, has reportedly acquired nearly a quarter of MicroStrategy’s $2.6 billion convertible note offering, reflecting the growing institutional interest in Bitcoin.

Allianz, the second-largest insurer in Europe, purchased 24.75% of MicroStrategy’s note sale for institutional investors, which closed on Nov. 21.

According to Bloomberg Terminal data shared by the pseudonymous analyst Petruschki in a Nov. 22 X post, the investment was made through four different sub-organizations. Petruschki noted:

“The positions were filed in July and October. The shares are held by the following sub-organizations: Allianz Global Investors Luxembourg 14.34%, Allianz Global Inv Of America LP 6.64%, Nicholas Applegate Cap MGMT Inc 3.74% and AllianzGlobal Investors GMBH 0.04%.”

This significant investment could directly impact the Bitcoin price rally, as MicroStrategy plans to use the funds to “acquire additional Bitcoin and for general corporate purposes.”

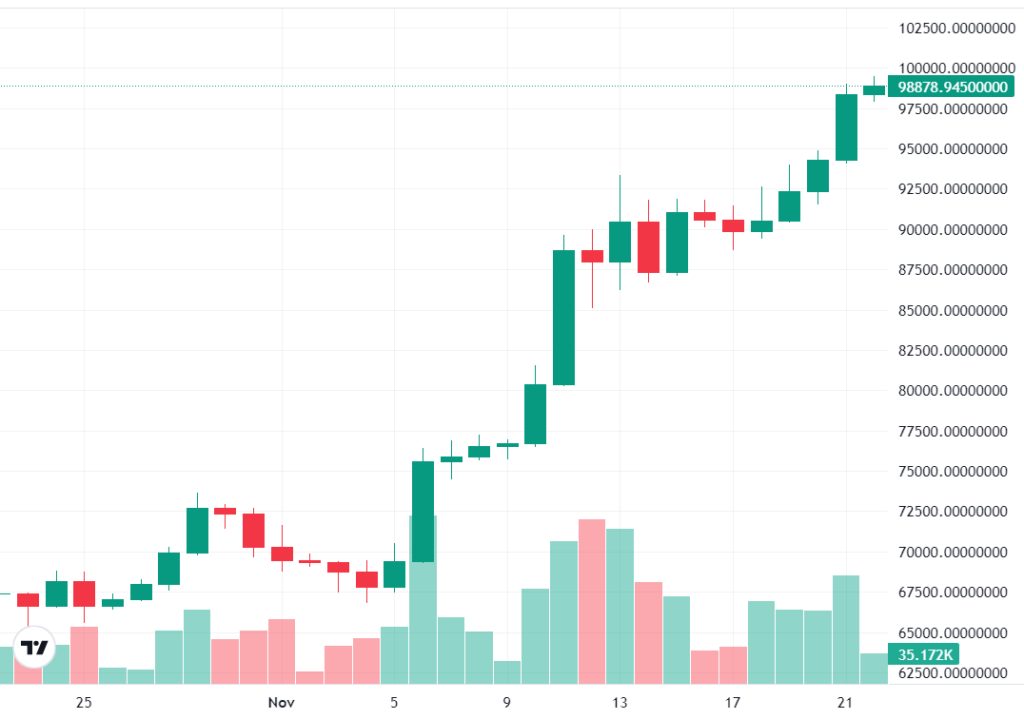

The news follows Bitcoin’s recent surge to a record high of $99,000, driven by the largest monthly candle in crypto history, with an increase of over 40%. Analysts are now anticipating that Bitcoin could break the $100,000 mark before the end of November.

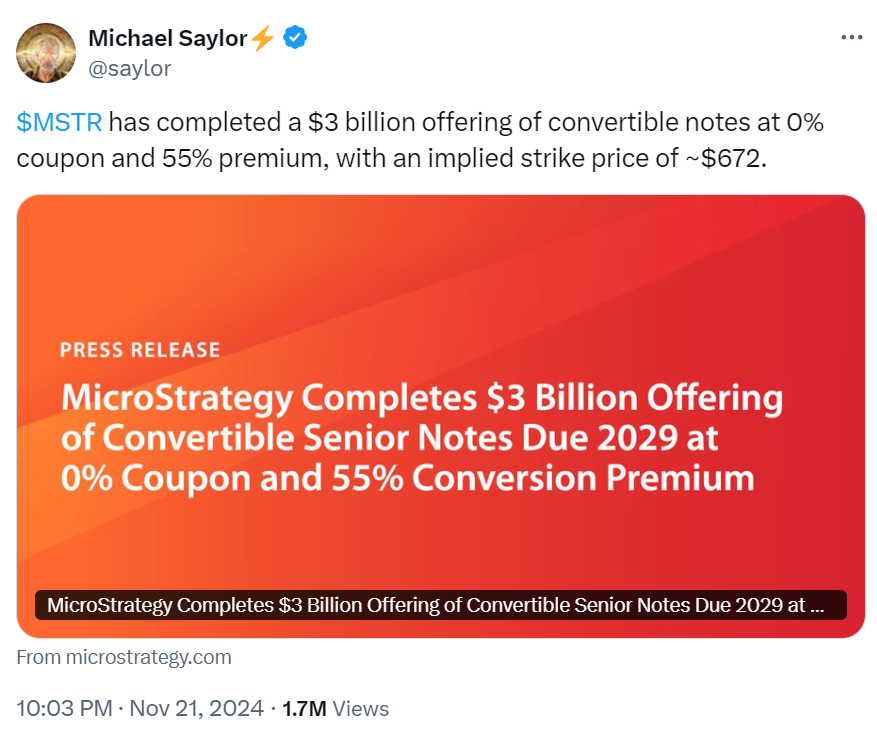

MicroStrategy Upsizes Note Offering to $2.6 Billion

MicroStrategy initially announced a $1.75 billion offering on Nov. 18. However, the world’s largest corporate Bitcoin holder decided to increase the offering to $2.6 billion by Nov. 20.

The offering closed on Nov. 21, raising $3 billion, signaling that initial purchasers had opted to buy the maximum additional notes available, according to Michael Saylor, the founder and CEO of MicroStrategy.

Saylor’s company plans to use the new capital to buy more Bitcoin, a move that could push Bitcoin above $100,000, possibly before the month ends, according to Ryan Lee, Chief Analyst at Bitget Research. Lee shared with Cointelegraph:

“If history repeats itself and Bitcoin prices grow as projected, a 14.7% increase from the current price level will push the coin well above the $100,000 target for the month. The post-halving cycle trend is also very positive when projecting the future of Bitcoin.”

However, there are concerns about the growing leverage in the crypto markets. On Nov. 12, Kris Marszalek, the co-founder and CEO of Crypto.com, cautioned that the market would need to go through a deleveraging phase before Bitcoin could surpass $100,000.