Regulatory concerns have hung over cryptocurrencies and related businesses all around the world for a long time, with the SEC imposing new rules on a number of organisations.

With crypto-assets such as XRP being accused of being a security by the Securities and Exchange Commission [SEC] of the United States and Binance receiving strong warnings from regulators throughout the world, the crypto-industry may wish to exercise caution.

With XRP’s future in the United States currently being debated in court, other cryptocurrencies may wish to solidify their places as digital assets before the Securities and Exchange Commission (SEC) comes knocking. Particularly noteworthy are initiatives that have been able to secure significant funding from traders such as Polkadot and Cardano.

Can the Department of Transportation and the American Disabilities Act avoid falling into the SEC’s trap?

According to the Securities and Exchange Commission (SEC), a security is anything that is sold or transferred for a value in which the purchaser is relying on the seller to improve the value of the object that was bought.

Following the advice of attorney Jeremy Hogan, the Securities and Exchange Commission has been successful in asserting that the simple act of marketing a cryptocurrency in a specific manner might be proof of a joint enterprise for profit between the seller and customer. We can see that the term has even been “stretched further out over the last 80 years or so,” as we previously stated.

Because the Securities and Exchange Commission views most initial coin offerings as securities sales, numerous initiatives like as the American Dream and the Department of Transportation (DOT) have found themselves in legal hot water.

Because ADA’s initial coin offering (ICO) took place in Japan, according to Hogan, the company “avoided the legal complications” of doing an ICO in the United States.

Because to Japan’s progressive stance on cryptocurrency, around 95 percent of the ICO’s sales were to Japanese citizens, with the remainder going to exchanges for distribution in the United States.

The SEC does not have jurisdiction in Japan, and as a result, it will be unable to take action against Cardano for breaking the country’s securities laws. As a result, the ADA is a safe initiative, at least from the standpoint of regulatory compliance in the United States.

The Department of Transportation, on the other hand, is not faring as well, according to the attorney.

The Polkadot platform was conceived and built by the Web3 Foundation, which performed three initial coin offerings (ICOs) in 2017 and raised an estimated total of about $200 million to far. These initial coin offerings (ICOs) took occurred before the Polkadot platform was fully operational, bringing it closer to the SEC’s definition.

Hogan went on to say,

“This is bad because sales of the DOT coin look more like an investment contract where buyers are relying on the efforts of the developers to increase the value of the tokens because when the tokens are sold before there even exists a platform to use them on – the inherent value of the token is Zero – nothing, so of course you are relying on the developer to make the platform so that the coin has some value.”

Further aggravating the situation, he pointed out that investors received 50% of the original tokens, while 8.4 percent were made available to private sale investors [such as exchanges].

On the contrary, 11.6 percent was held by the Web3 Foundation for future fundraising reasons, and 30 percent was provided to Web3 for the purposes of development and infrastructure development and deployment.

Unfortunately, while this may sound negative, the Web3 Foundation is a non-profit organisation based outside of the United States. As a result, it is outside the regulatory jurisdiction of the SEC.

Additionally, the selling of initial coin offerings (ICOs) was prohibited in China and the United States due to the same regulatory concerns raised by the SEC.

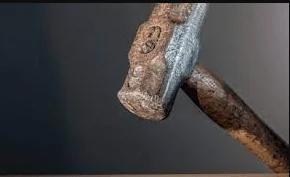

Every one of these defences will be put to use if the SEC launches an investigation into whether or not DOT was sold in the form of a security. If an exchange within the country did sell DOT, as it did during its initial coin offering, the SEC’s hammer may fall.

In view of the SEC’s recent measures, crypto-projects may wish to begin putting up their defences as soon as possible.

While the American Dental Association (ADA) may be able to avoid the SEC’s regulatory lasso, the Department of Transportation (DOT) may not be so fortunate. Only time will tell if the regulators are successful in their efforts to bring it down.