The optimism surrounding a potential altseason has faded, with altcoins correcting between 10 and 20%. The drop in altcoin FOMO signals a possible bottom formation.

FOMO has finally subsided for the better following a significant surge in anticipation of a mega rally in the altcoin market and the potential altseason.

Over the past week, the altcoins have experienced a correction of 10-20%, with the exception of a few, such as Ethereum.

Altseason FOMO Cools Down Suggesting Market Bottom

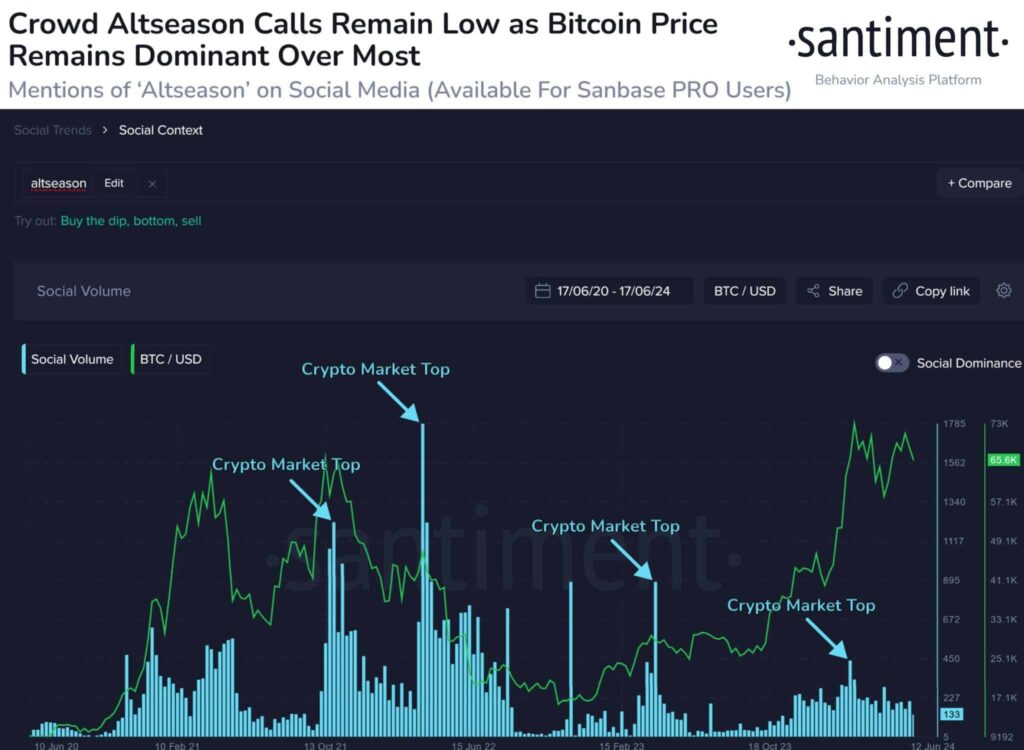

On-chain data provider Santiment has identified a significant trend in the altcoin market.

Altseason’s increasing mentions frequently correspond with market highs and lows, according to its analysis.

This implies that the traders have become excessively eager, as their interest in altcoin has surged, which could indicate a potential market top.

However, the fear of missing out (FOMO) has decreased significantly since the market peak in March.

The Santiment data suggests that the present climate of crowd fear has the potential to bring us closer to a market bottom, thereby offering a significant opportunity to investors.

Additionally, the community sentiment for large-cap altcoins, such as Shiba Inu (SHIB), Dogecoin (DOGE), and XRP, has experienced a substantial dip following the recent price declines, as indicated by the Santiment data.

Santiment suggests that this sentiment shift may offer a buying opportunity for patient traders.

Investors who have been waiting for the market to cool off may contemplate deploying fresh cash in the market as the FOMO levels reach their 2024 lows.

Done Expect Imminent Altcoin Bull Run

Most altcoins have continued to trade below their highs, despite the Bitcoin price fluctuating around its all-time highs.

Benjamin Cowen, a renowned crypto analyst, has suggested that the enthusiasm for an imminent altcoin bull run may be premature.

He also stated that a significant increase is improbable until the US Federal Reserve resumes cutting interest rates again.

Historically, altcoins have consistently generated substantial returns following the Fed rate cuts. Cowen stated:

“The decline in the majority of altcoins is mirrored in the falling advance/decline index, echoing the period leading up to the Fed’s rate cut in 2019. This index saw a sharp decline before the Fed initiated rate cuts in July of that year. It’s essential to track these movements because the anticipation of an altcoin season dominating Bitcoin may be premature without a reduction in interest rates by the Fed.”