As much as there are Bitcoin lovers, there are also those who do not buy the idea of the cryptocurrency, some people have attributed their dislike for it to be due to its volatile nature and susceptibility to fraud.

In a recent attack, Steve Hanke, an economist at Johns Hopkins University, slammed Bitcoin. Hanke described Bitcoin as “snake oil,” noting that the crypto bulls are selling their supplies to retail investors. Hanke adds in a recent Twitter message:

Don’t buy the #Bitcoin snake oil the crypto bulls are selling. Its extreme volatility, susceptibility to fraud, and uncertainty are all reasons why BTC will never be suitable as a true currency. Bitcoin is a highly speculative asset, with a fundamental value of ZERO.

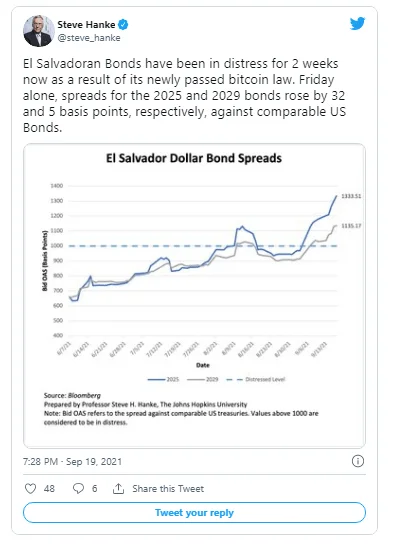

Furthermore, the economist chastised El Salvador for recently enacting a Bitcoin law. He mentioned how El Salvador’s bonds have been in trouble for the past two weeks since the country’s adoption of the Bitcoin law.

According to a Reuters story published last week, S&P Global believes El Salvador’s adoption of Bitcoin will have immediate “negative effects” on the country’s credit ratings.

“The risks associated with the adoption of bitcoin as legal tender in El Salvador seem to outweigh its potential benefits,” it added.

Bitcoin has been under pressure in September so far, following a good performance in August last month. Over the last 20 days, it has been trading at a loss.

However, September has historically been a month of selling pressure for Bitcoin and the entire crypto industry.

However, the fourth quarter of 2018 has been a favourable one for the world’s largest cryptocurrency. As a result, market analysts remain enthusiastic, with many predicting that Bitcoin will reach $100K by the end of the year.