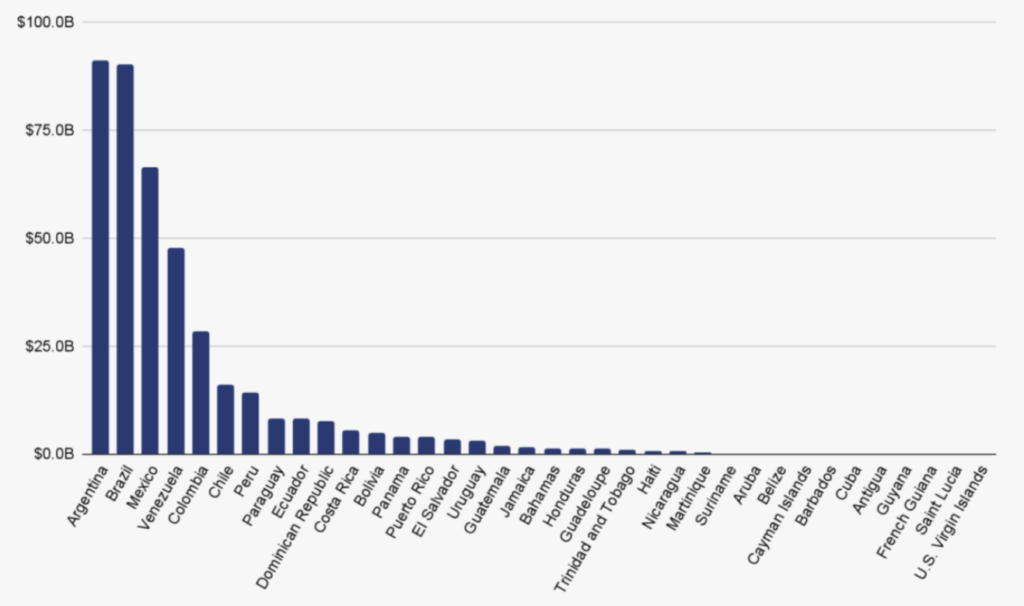

Argentina leads Latin America in crypto inflows with $91 billion, slightly surpassing Brazil’s $90 billion, according to Chainalysis.

Argentina, a cryptocurrency market experiencing rapid expansion, has overtaken Brazil as the leading Latin American country in terms of the estimated amount of bitcoin users have brought in.

Chainalysis published a survey on October 9 revealing that between July 2023 and June 2024, cryptocurrency users in Argentina deposited the largest amount in Latin America, totaling $91 billion.

They has surpassed Brazil in terms of total cryptocurrency value received, according to estimates, with a total of $91 billion in cryptocurrency inflows. Argentina’s $91 billion in cryptocurrency inflows puts it slightly ahead of Brazil’s projected $90 billion over the period.

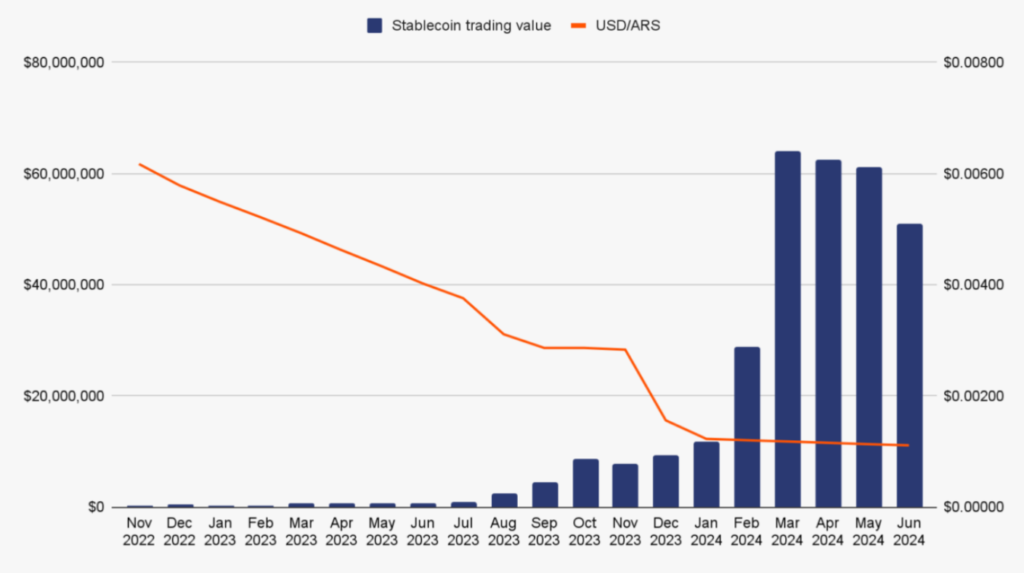

Argentina’s decades-long battle with inflation and local currency devaluation has compelled the country’s population to explore alternative methods of saving money, including the use of US dollars or dollar-fixed stablecoins. This has led to the rapid increase of cryptocurrency adoption in Argentina.

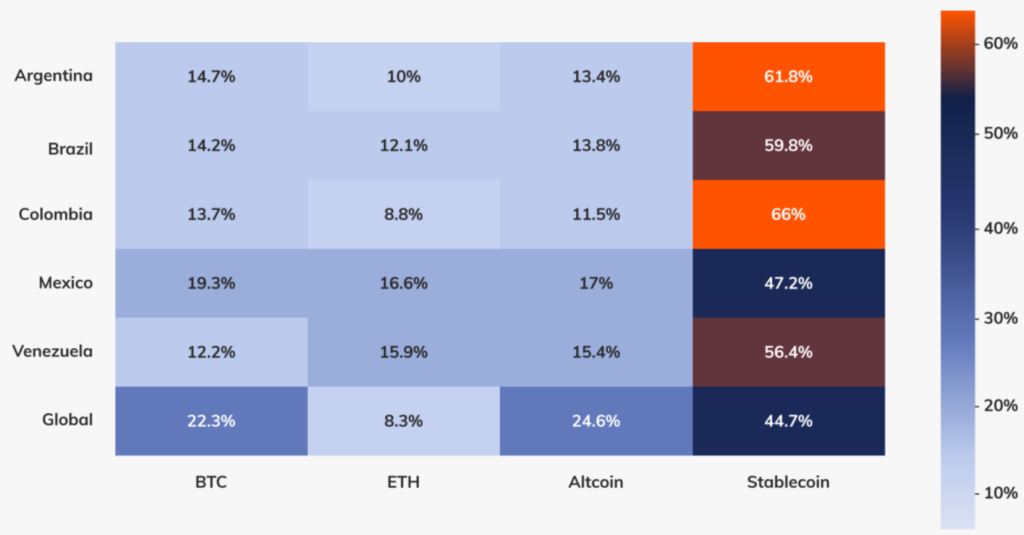

According to Chainalysis’s analysis, the stablecoin market in Argentina ranks among the largest globally in terms of the proportion of transactions involving stablecoins. The company is also one of the most successful in Latin America. Between the months of July 2023 and June 2024.

Argentina’s part of the volume of transactions involving stablecoins amounted to 61.8%, which was slightly higher than Brazil’s portion of 59.8%. The stablecoin activity in is significantly higher than the global average of 44.7%, but it is lower than the 66% activity in Columbia.

The analysis emphasized the fact that the proportion of stablecoin transactions in Argentina that are of a retail size, defined as those that are less than $10,000, is expanding at a quicker rate than any other asset category.

“Their interest in stablecoins highlights the role of crypto in unstable markets and how citizens are able to take better control of their financial futures by embracing cryptocurrency, regardless of official monetary policy.”

Based on this pattern, it appears that Argentinians are turning to stablecoins as a means of safeguarding their financial resources against the effects of inflation and currency volatility.

According to the report, the increasing volume of stablecoin activity in Argentina is a result of the fact that the stablecoin issuer Tether is shifting its focus away from industrialized economies like the United States and toward emerging markets like Argentina.

Tether USDt is the operator of the largest US dollar-pegged stablecoin in the world for the time being. Tether’s CEO Paolo Ardoino stated that the company was aware of Argentina’s requirement for a “digital dollar”. People want to hold that dollar, not in cash, but in a digital form because it is much more convenient,” Ardoino said. “That dollar is not available in cash.

Increasingly, they have positioned itself as a country that is welcoming toward cryptocurrencies. After Javier Milei, a pro-Bitcoin president, assumed office in December 2023, Argentina formally acknowledged the use of Bitcoin in legally binding contracts.

This occurred toward the end of the year 2023. The government of the country has not yet taken any steps to control the rapidly expanding cryptocurrency industry, despite the fact that Argentina has become one of the most active countries in that regard.

Forbes reports that the country has been having difficulty providing regulated cryptocurrency services to its populace in July, despite the fact that the government has made several attempts to implement appropriate legislation.

Argentina has not yet implemented a stablecoin framework, in contrast to industrialized economies such as those in Europe, who have been lobbying for stablecoin laws for the past few years.