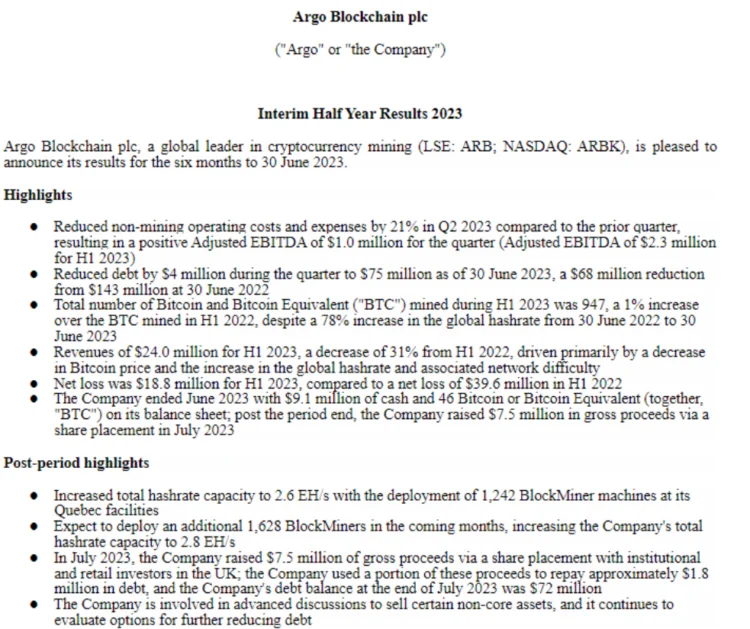

Cryptocurrency mining firm Argo Blockchain reports a total debt of $75 million as of June 30, 2023, a $68 million reduction from $143 million in June 2022.

Argo Blockchain mining company is one of several firms to struggle amid adverse market conditions and a highly competitive mining ecosystem, it reported net losses of $18.8 million for the first half of 2023, a decrease of over 50% from the net loss of $39.6 million for the first half of 2022.

Argo also reports a $4 million debt reduction in 2023, bringing its total debt to $75 million. The company has reduced its debt by $68 million from $143 million in June 2022.

Revenues were 31% lower than in H1 2022, with Argo earning $24 million in the middle of 2023. This decline was attributed to a decrease in Bitcoin’s value and increased global hash rate and network difficulty.

Argo reports that it mined 947 BTC in the first half of the year, a 1% increase compared to the number of BTC mined during the same period in 2022. Notably, the global hash rate increased by 78% in 2023.

Argo’s balance accounts reflect $9.1 million in cash and 46 BTC as of June 2023. In July 2022, Argo began the year’s second half by raising $7.5 million in aggregate proceeds from institutional and retail investors through a share placement.

While the company had previously warned that it faced the possibility of bankruptcy in late 2022, its 2023 interim half-year results indicate that it intends to deploy 1,628 BlockMiners to its Quebec-based mining facilities to increase its total hash rate capacity to 2.8 exahases per second (EH/s).

Additionally, Argo disclosed that it was in advanced negotiations to sell “certain non-core assets” and was investigating other options to reduce its overall debt.

Argo’s board chairman, Matthew Shaw, highlighted a “transformational series of transactions” in which the company transferred its Helios mining facility and property to Galaxy Digital for $65 million in December 2022. Galaxy provided Argo with a new $35 million, three-year asset-backed loan.

“The transactions reduced total indebtedness by $41 million and allowed Argo to simplify its operating structure.”

Shaw added that Argo’s capacity to maintain a fleet of more than 27,000 miners was crucial to its ongoing operations, with approximately 23,600 Bitmain S19J Pro operating at the Helios site via a hosting agreement with Galaxy.

Before striking an agreement with Galaxy for its Helios facility, Argo had previously warned that it would face dire financial circumstances by the end of 2022. In the months following the completion of the transaction, former Argo CEO Peter Wall resigned from the company.