Bitcoin miner Argo Blockchain has completed the repayment of $35 million in debt, which was borrowed from asset manager Galaxy Digital in 2022 to prevent insolvency during the crypto bear market of that year.

In a statement, Argo CEO Thomas Chippas stated that the repayment is “a significant milestone for Argo” and was completed “without any meaningful impact to Argo’s hashrate.”

In a specific period, the computational capacity of a cryptocurrency mining operation is directly proportional to the amount of Bitcoin that a miner can earn. This is known as hashrate.

Argo narrowly evaded insolvency in December 2022 by agreeing to a multi-part agreement with Galaxy. The agreement included selling its Helios Bitcoin mining facility in Dickens County, Texas, for $65 million and refinancing its debt with a $35 million loan.

“The loan was collateralized by 23,619 Bitmain S19J Pro mining machines currently operational at Helios and specific machines located at Argo’s Canadian data centers,” Argo stated. Argo agreed to lease back space in Helios to continue operating its Bitcoin mining device as part of the agreement.

Argo has since expanded its mining capabilities, deploying approximately 2,750 BlockMiner devices from ePIC Blockchain Technologies in the third quarter of 2023, as indicated in its 2023 annual report.

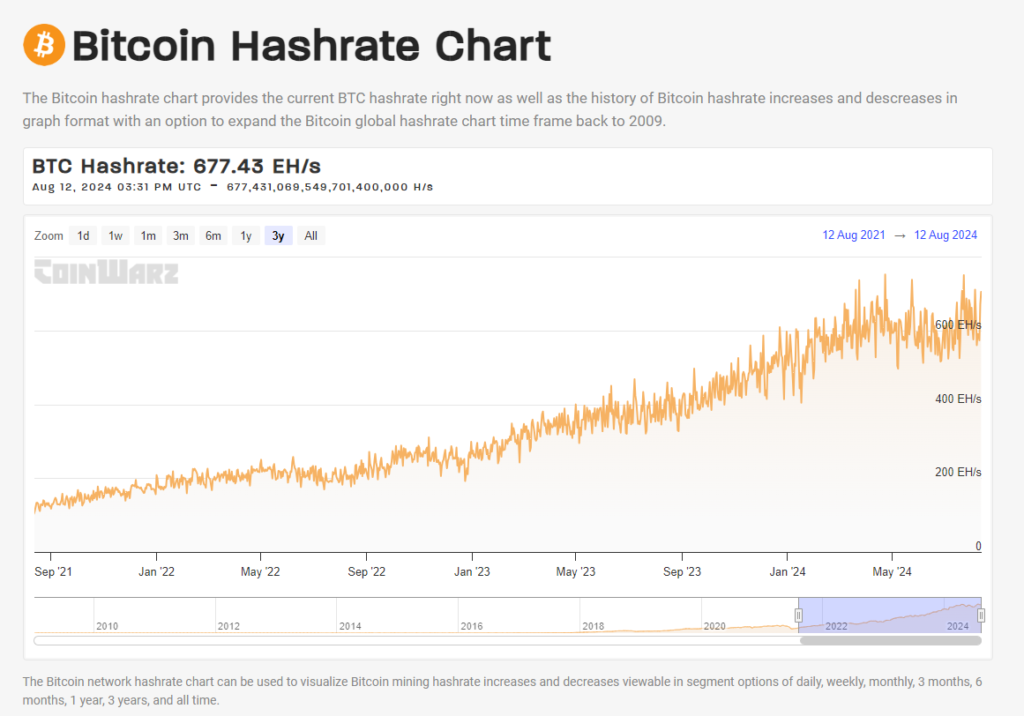

As of the conclusion of 2023, Argo maintained a hashrate of 2.7 exahashes per second (EH/s). According to CoinWarz data, the Bitcoin network’s total hashrate is 677.43 EH/s. The company announced that Argo mined 48 BTC in July, an average of 1.5 BTC daily.

According to a report by Benchmark analyst Mark Palmer, Galaxy disclosed “strategies to enhance and capitalize on the high-voltage power capacity of its flagship Helios data center in Dickens County, Texas,” on August 1.

Palmer predicted Helios will capitalize on “the anticipated demand for substantial power from high-performance computing (HPC) projects and artificial intelligence.”