ARK Invest and 21 Shares’ joint spot Bitcoin ETF has not yet been listed, which is unfortunate for those who closely track new Bitcoin ETF filings.

Despite social media speculation, ARK Invest’s spot Bitcoin exchange-traded fund (ETF) does not appear to be listed on the Depository Trust & Clearing Corporation (DTCC) website.

On Oct. 25, several prominent crypto Twitter accounts, including Mike Alfred, Bitcoin News, Simply Bitcoin, and Crypto News Alerts, posted tweets and screenshots alleging that ARK Invest and 21 Shares’ joint spot Bitcoin ETF had been listed on the DTCC’s site.

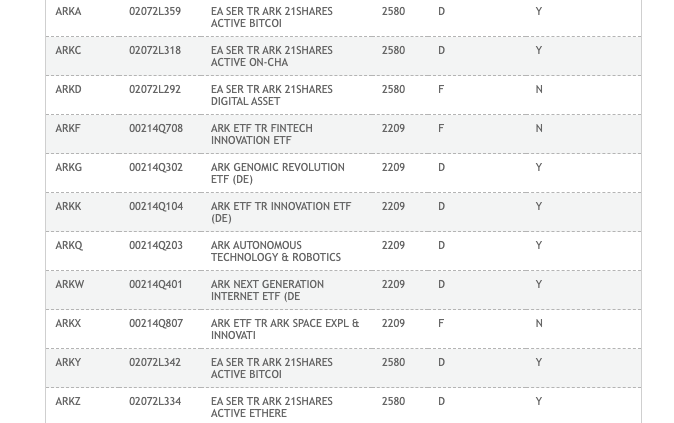

However, none of the screenshots displayed the correct ticker for the spot Bitcoin ETF, displaying instead tickers for futures-related products.

The most recent amended filing for Ark’s spot Bitcoin ETF, dated Oct. 11, reveals that the fund’s ticker symbol will be “ARKB.”

The section of the DTCC website displaying all current ETF listings does not include ARKB as of Oct. 25.

The symbol “ARKA” refers to the ARK 21Shares Active Bitcoin Futures ETF, which, according to its most recent filing on Aug. 11, is an unapproved fund that will provide investors with exposure to Bitcoin futures contracts.

The tickers ARKY and ARKZ refer to the ARK 21Shares Active Ethereum Futures ETF and the ARK 21Shares Active Bitcoin Ethereum Strategy ETF, respectively. Both of these products are still pending SEC approval.

It appears that the iShares listing news was also exaggerated.

While the crypto market surged upon hearing that BlackRock’s iShares spot Bitcoin ETF (IBTC) had been listed on the DTCC’s website, a DTCC spokesperson recently disclosed that IBTC had been listed since August.

According to the spokesperson, it is standard procedure for the DTCC to add securities to the NSCC security eligibility file “in preparation for the launch of a new ETF on the market.”

“Appearing on the list is not indicative of an outcome for any outstanding regulatory or other approval processes,” the spokesperson added.

BlackRock’s listing of spot ETF on the DTCC website coincided with a 14% one-day rally for Bitcoin, which briefly surpassed $35,000 for the first time in nearly two years.

At the same time rumors of an ARK listing began to circulate, Bloomberg senior ETF analyst Eric Balchunas reported that ARK Invest had submitted a fourth amendment to its spot Bitcoin ETF application, which appeared to be primarily cosmetic.