Cathie Wood’s ARK Invest acquired 200,275 SOFI shares, approximately worth $1.5 million, on November 29, as SoFi announced plans to terminate crypto services by the end of 2023.

ARK acquired 200,275 SOFI shares on November 29 for allocation to its ARK Fintech Innovation ETF (ARKF). Reporting by TradingView, the value of the sum is $1.47 million, or $7.35 per share, based on SOFI’s closing price on November 29.

ARK completed its most recent SOFI acquisition on the same day that SoFi Technologies formally declared its intention to cease cryptocurrency services by December 19, 2023.

“We have decided to terminate our cryptocurrency services by the end of the year,” SoFi announced, instructing its clients to transfer their cryptocurrency holdings to the Blockchain.com online cryptocurrency wallet.

ARK has been an active purchaser of SoFi shares for ARKF thus far this year, amassing a total of 1,772,991 SOFI. The current valuation places the value of ARKF’s SoFi exposure at approximately $13 million.

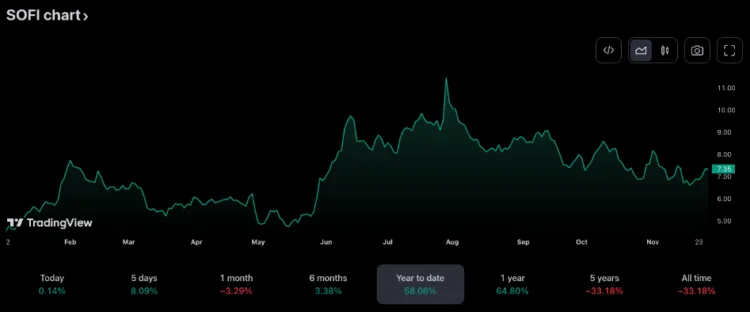

In 2023, SoFi stock has experienced some volatility, rising from $4.5 at the beginning of the year to $11.45 in July. Since then, SoFi shares have been declining incrementally, falling below $7 by mid-November.

ARK has been actively purchasing Robinhood (HOOD) shares in addition to SoFi, amassing 221,759 HOOD on November 29. The trading application of Robinhood enables U.S. residents to buy and sell cryptocurrencies such as Bitcoin.

On November 30, the platform formally declared its intentions to extend its operations into the United Kingdom, yet failed to specify whether the offering would include cryptocurrency.

Although ARK has been investing in SoFi and Robinhood, it has maintained a sale of Coinbase (COIN) stock. ARK sold approximately 38,000 COIN shares from the ARKF ETF on November 29 for nearly $5 million.