Cathie Wood’s ARK Invest sold 237,572 of its Coinbase (COIN) stock for $140 per share and about $33 million in yield.

ARK sold a maximum of 237,572 Coinbase shares from its three funds on December 5. The transaction occurred as Coinbase shares closed at $140 per share that day, yielding a minimum of $33 million.

The trading firm divested 201,711 Coinbase shares originating from the ARK Innovation ETF (ARKK). The ARK Fintech Innovation ETF (ARKF) and the ARK Next Generation Internet ETF (ARKW) sold an additional 28,535 COIN and 7,326 COIN, respectively.

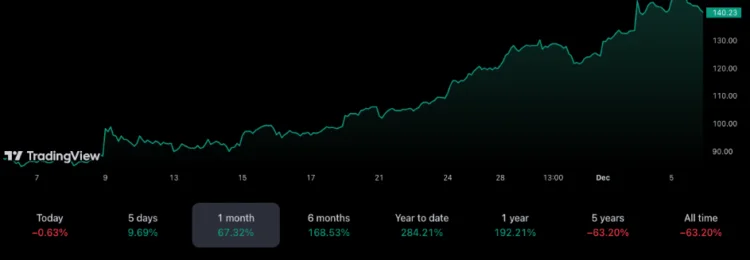

TradingView data indicates that, following the bullish cryptocurrency market, Coinbase’s stock has surged 280% year to date (YTD). This represents a new annual high for the exchange’s stock. Following the November pleas of former CEO Changpeng Zhao and rival exchange Binance to charges of money laundering and sanctions violations in the United States, COIN shares have also been on the rise.

The Coinbase stock surpassed $147.4 on December 5, marking a new all-time high not observed since April 2022. Also, according to TradingView, the stock has gained nearly 70% in the last thirty days.

The most recent Coinbase sale by ARK ranks third in terms of daily COIN sales in 2023, behind only the 478,356 COIN sales that occurred on July 14 and the 248,838 COIN sales on July 17. Coinbase stock was trading around $105 at the time.

Aside from selling aggressively on Coinbase, ARK has also liquidated 168,127 Grayscale’s Bitcoin Investment Trust (GBTC) shares. TradingView reports that the transaction generated $5.9 million at the $35 closing price.

The firm commenced the sale of Grayscale Bitcoin Trust shares on October 23, 2023, coinciding with the approaching $34,000 price of Bitcoin.

ARK continues to retain a substantial number of COIN shares as one of its most valuable assets despite its recent activity in selling Coinbase stock. As of December 5, Coinbase remains the most valuable asset in the ARKF ETF’s portfolio, comprising over 13% of its net assets and worth nearly $135 million.

The largest asset of the ARKW ETF and the ARKK ETF is COIN, which comprises 11.72% and 11.64% of the two funds, respectively.

Despite selling COIN, ARK has purchased other crypto-related equities, including Robinhood (HOOD). Furthermore, despite disclosing its intention to discontinue cryptocurrency trading services, the firm has continued to acquire shares of SoFi technologies.