Cathie Wood’s Ark Invest has been selling its shares of ProShares Bitcoin Strategy ETF (BITO) to buy more units of Ark 21Shares Bitcoin ETF (ARKB), its own spot Bitcoin ETF. This move shows Ark Invest’s confidence in its active fund management strategy and preference for spot exposure to Bitcoin.

Ark Invest swaps BITO for ARKB

Cathie Wood’s asset management firm, Ark Invest, has been making a major shift in its Bitcoin ETF holdings. The firm has been offloading its parked holdings in ProShares Bitcoin Strategy ETF (BITO), the first Bitcoin futures ETF in the US, to invest in its newly launched Ark 21Shares Bitcoin ETF (ARKB), the first spot Bitcoin ETF in the US.

ETF experts believe that this move could signal Ark Invest’s intention to bring its active fund management strategy to the entire crypto exchange-traded funds (ETFs) space.

According to the latest data from Ark Invest, the firm sold 510,337 shares of BITO valued at approximately $10 million and 45,052 AMD shares worth $7.8 million on January 19, 2024.

The firm used the proceeds to buy 316,526 units of ARKB worth more than $13 million. This was not the first time that Ark Invest reduced its units of BITO to increase its holdings in ARKB.

On January 18, 2024, the firm sold 758,915 BITO units worth $15 million to buy 365,695 units of ARKB worth $15 million. Similarly, on January 16, 2024, the firm sold 757,664 BITO units worth $15.8 million to buy 365,427 units of ARKB worth $15.8 million. In total, the firm has purchased 1.04 million units of ARKB worth $43 million in a week.

Ark Invest bets on spot Bitcoin ETF

Ark Invest’s decision to dump BITO and buy more ARKB shows the firm’s confidence in its own Bitcoin ETF and its preference for spot exposure to Bitcoin. BITO is a Bitcoin futures ETF which tracks the price of Bitcoin futures contracts traded on the Chicago Mercantile Exchange (CME).

BITO does not hold any actual Bitcoin but rather relies on the futures market to reflect the price of Bitcoin. However, the futures market can suffer from inefficiencies, such as contango and backwardation, which can cause the price of BITO to deviate from the price of Bitcoin.

ARKB, on the other hand, is a spot Bitcoin ETF, which means that it holds actual Bitcoin in custody and tracks the price of Bitcoin directly. It offers investors a more transparent and convenient way to gain exposure to Bitcoin without dealing with the complexities and risks of buying and storing Bitcoin themselves.

ARKB also charges a lower expense ratio than BITO, 0.95% versus 1%.

Ark Invest is known for its active fund management strategy, which involves picking and choosing the best-performing stocks and sectors based on its research and analysis. The firm has demonstrated its commitment and vision to the crypto industry by launching its spot Bitcoin ETF.

Ark Invest Bitcoin ETF price and performance

Ark 21Shares Bitcoin ETF (ARKB) was launched on January 11, 2024, after receiving approval from the US Securities and Exchange Commission (SEC) on December 28, 2023. The ETF is listed on the NYSE Arca exchange and trades under the ARKB ticker.

ARKB is a partnership between Ark Invest and 21Shares, a Swiss-based crypto ETF provider. The ETF uses Coinbase Custody as its custodian and Fidelity Digital Assets as its sub-custodian. The ETF tracks the performance of the 21Shares Bitcoin USD Price Index, which is calculated by CryptoCompare.

Since its launch, ARKB has seen a strong demand and interest from investors, as well as a positive price performance. The ETF closed 1.90% higher at $41.73 on January 19, 2024, after hitting an intraday high of $42.18.

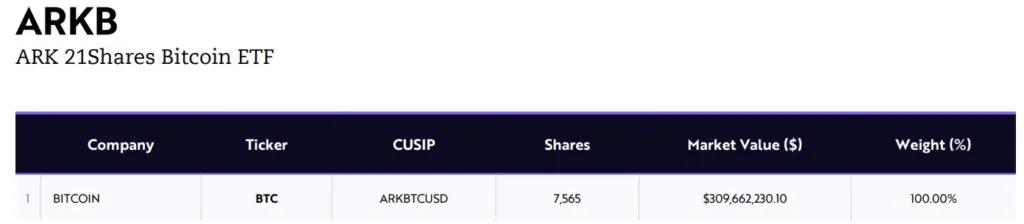

The ETF also saw a 3.56% fall this week, following the volatility and correction in the Bitcoin market. As per Ark Invest data until January 19, 2024, ARKB has Bitcoin worth $309.66 million under its management.