Attestor Capital, a leading FTX claim holder, has initiated legal proceedings against Lemma, a seller in the insolvency claims market, after making a 200% profit on the purchased FTX claims stash.

The London-based hedge fund Attestor specializes in private equity and distressed assets. In addition to Diameter Capital Partners and Silver Point Capital, the firm has emerged as one of the largest purchasers of FTX’s bankruptcy assets.

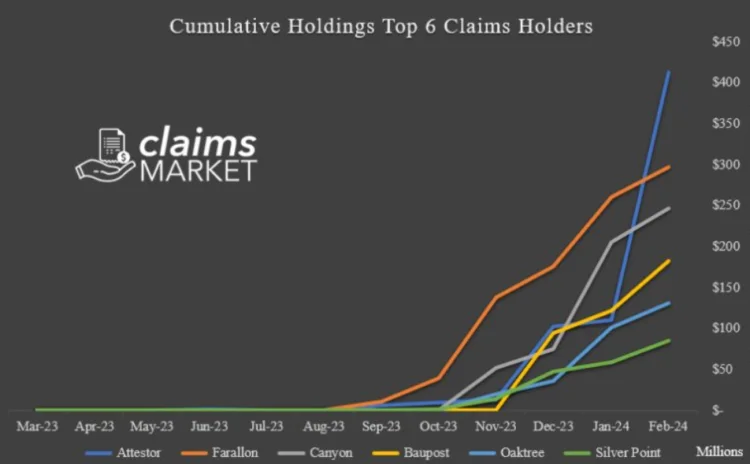

According to data from the Claims Market, Attestor was the largest purchaser of FTX claims in February, purchasing claims worth at least $400 million.

Bloomberg reported on March 18 that Attestor filed a lawsuit against Lemma Technologies, the vendor of one of the largest FTX accounts it acquired, after attaining 200% profit on its FTX claims hoard.

As per Attestor’s findings, Lemma entered into a contractual agreement with the company to sell FTX claims for $58 million in June 2023. Following this, the company withdrew from the deal in response to the soaring prices of cryptocurrencies, with Bitcoin up nearly 130% year-over-year at the time of writing.

The Attestor allegedly stated in the lawsuit that Panama-based Lemma ultimately decided to retain the claim, claiming that the defendant had acted with “seller’s remorse.”

Lemma has neither publicly explained its position nor filed a defense against Attestor’s New York lawsuit, per Bloomberg.

Attestor attorneys stated in their filing that Lemma will not “proceed with the transactions or otherwise honor the trade confirmations” “unless legally obligated to do so.”

In addition to the recent litigation that Lemma is confronting in New York, a vital employee of the organization has encountered legal complications in South Korea.

According to reports, South Korean authorities indicted Junho Bang, the principal investor in Lemma, following his detention in January, on charges of stealing digital assets from the defunct cryptocurrency lending firm Haru Invest.

Previous information indicated Haru Invest operated a cryptocurrency yield platform, which guaranteed investors an annual return of 12% on cryptocurrency deposits. In June 2023, the platform inexplicably halted withdrawals, attributing the suspension to complications with service partners.

Following this, prosecutors in South Korea apprehended the CEO of Haru Invest and two additional executives on charges of embezzlement, which involved the theft of $830 million from thousands of clients.