AUSTRAC reports a rise in crypto-related money laundering and calls for stricter regulations.

In its most recent report on money laundering, the Australian Transaction Reports and Analysis Centre (AUSTRAC), a financial intelligence government agency, disclosed an elevated level of criminal utilization of cryptocurrencies and associated services.

The 2024 AUSTRAC Money Laundering National Risk Assessment provided a comprehensive analysis of criminals’ methods to launder money, including a significant increase in the illicit use of digital currencies, digital currency exchanges, and unregistered remittance services.

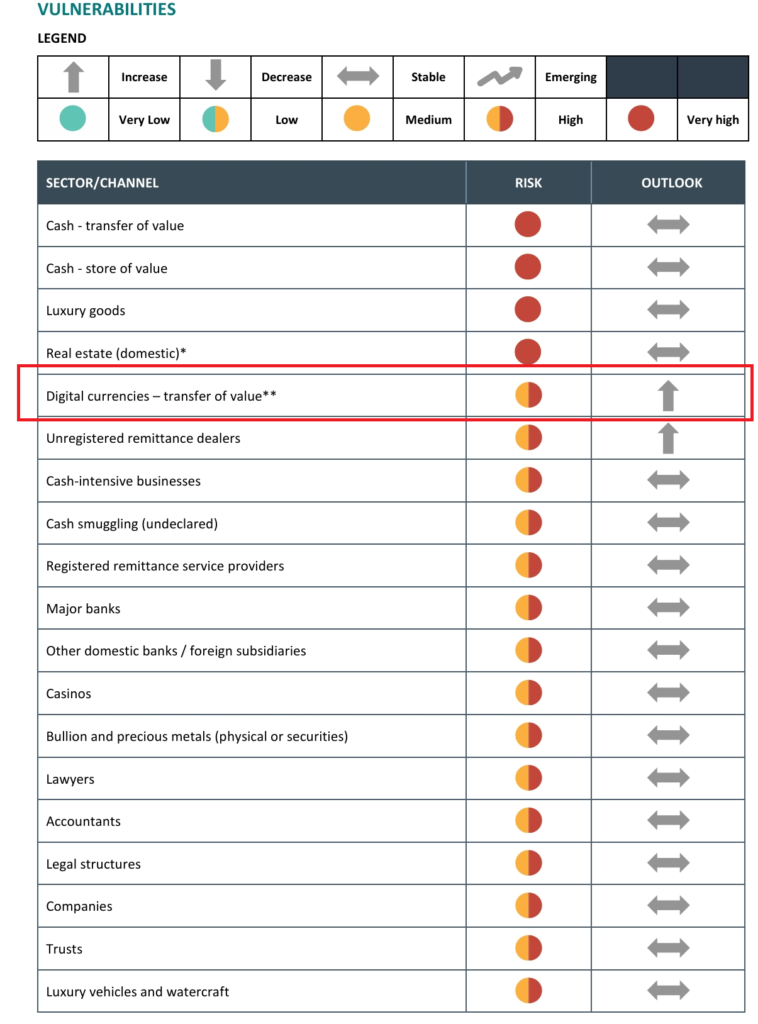

In spite of the widespread adoption of global digitization, the majority of money launderers continue to favor conventional methods for the illicit transfer of funds, including cash, real estate, and luxury products.

As demonstrated above, a “very high” risk factor was assigned to the aforementioned traditional channels, whereas digital currencies were assigned a “high” risk factor that was comparatively lower. Nevertheless, AUSTRAC predicts that the illicit use of cryptocurrencies will rise due to the faster transaction speed and increased anonymity.

The primary conclusions of the report were as follows:

“Criminal use of digital currency, digital currency exchanges, unregistered remitters and bullion dealers is increasing.”

Subsequently, the Australian agency reiterated the necessity for crypto exchanges to register with AUSTRAC in accordance with the AML/CTF Act.

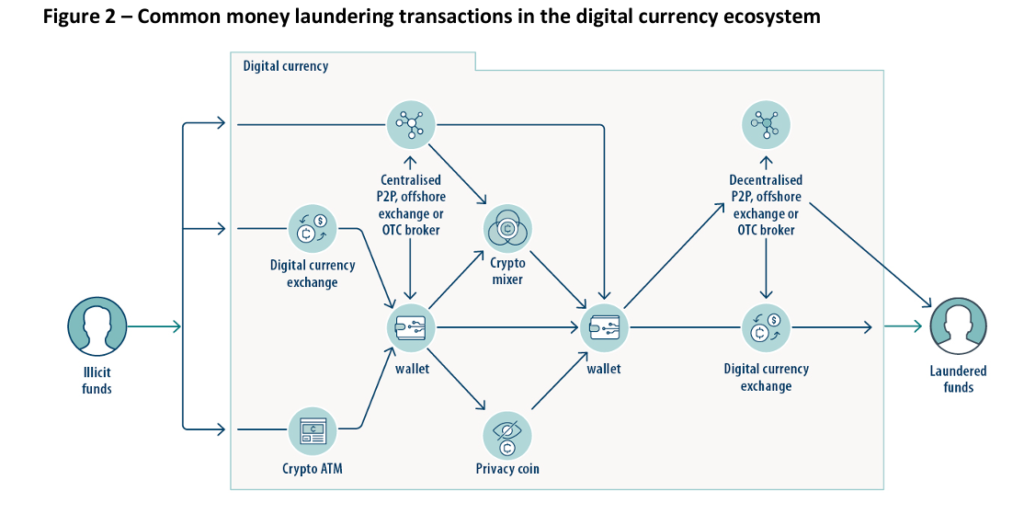

The report also provided its perspective on the crypto ecosystem, stating:

“The use of digital currency as a value transfer mechanism will pose an increasing money laundering vulnerability over the next three years. As the use of digital currency expands for legitimate use, opportunities for criminal use will also increase.”

In order to effectively combat money laundering activities involving crypto and digital assets, the report also emphasized the necessity of ongoing adaptation of regulatory measures and international cooperation.

The Australian government has recently prohibited using credit cards and cryptocurrency for online wagering.

Fines of up to approximately 234,750 Australian dollars ($155,000) may be imposed on companies that do not adhere to the new Australian regulations.

Kai Cantwell, the CEO of Responsible Wagering Australia, an independent organization for Australian-licensed wagering service providers, thinks that the change facilitates self-regulation.

“This is a critical measure to safeguard customers, enabling them to maintain control over their gambling behavior,” he emphasized.