Azuki Elementals NFTs, a derivative of the popular anime-themed PFP project, faced criticism over their similarity to the original collection. The NFT market dipped after the launch.

Azuki, a Los Angeles-based Web3 company that launched an anime-themed PFP (profile picture) project in 2022, has disappointed its fans with its latest NFT collection.

The company released 20,000 Elementals NFTs on June 27 as the next phase of the Azuki project. However, many collectors and creators felt that the Elementals NFTs were too similar to the original Azuki PFPs, with only minor changes and some artwork errors.

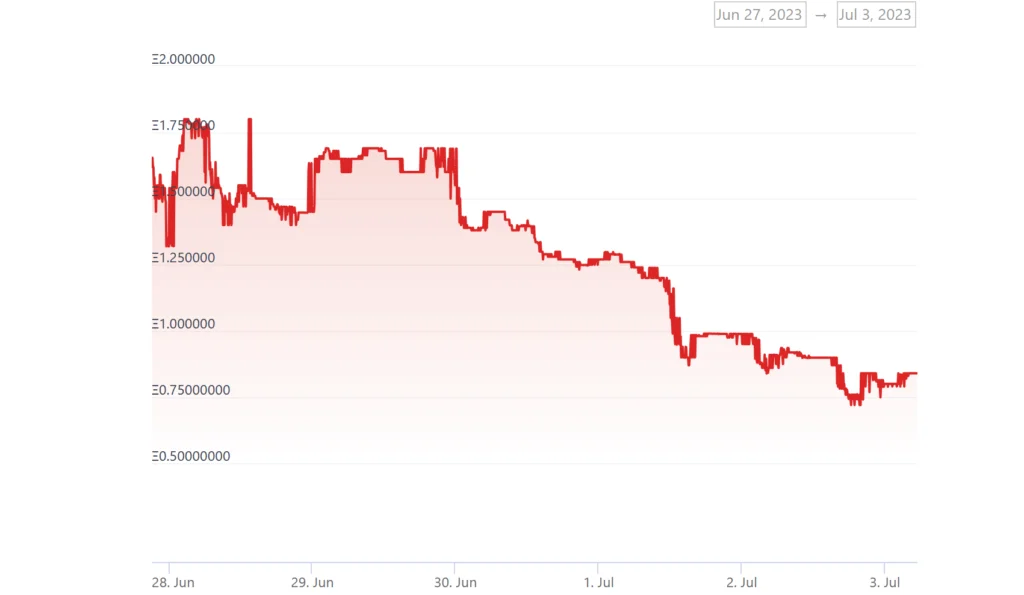

The Elementals NFTs sold for 2 ETH (about $3,800) each at launch, but the floor price has dropped to below 0.8 ETH within a week, according to data from OpenSea.

According to DappRadar, the original Azuki PFPs suffered a 34% price decline within 24 hours of the Elementals mint.

‘Out of touch’ with the community

The Azuki community expressed dissatisfaction and frustration on social media, questioning the uniqueness and value of the Elementals NFTs. Some said they felt misled and betrayed by the company, which had promoted the Elementals as a new and exciting collection.

Some also pointed out some strange mistakes in the artwork, such as a person holding a magic wand that seems to be missing its handle. Others said they were selling their original Azuki NFTs, fearing that the Elementals would devalue the project.

The official Azuki Twitter account issued a statement on June 28, acknowledging its mistakes and blaming its “ambitious goals.” The company said it was working hard to make things right and restore community trust.

However, for some holders, it was too late. Arthur0x, the founder of crypto investment firm DeFiance Capital, said he was selling five of his seven Azuki NFTs after the Elementals launch.

He said he was “disappointed and surprised” by how out of touch Azuki was with the community.

NFT market struggles amid crypto slump

The Azuki Elementals launch highlights the fragile state of the NFT market, which has been struggling amid a prolonged crypto slump.

The overall market value of the NFT market has fallen by 53% to 3.33 million ETH in the past year, according to NFTGo.

The most successful NFT projects have survived by building strong communities and providing value to their members. In a down market, cultivating this community becomes even more important.

Collectors who are active during bear markets are those who are deeply invested in the progress and development of their favorite projects.

Azuki’s case shows how a misstep can damage a project’s reputation and trust with its community. It also shows how challenging it is to create original and innovative NFT collections that stand out in a crowded and competitive space.

Investors are advised to do their own research and due diligence before buying any NFT platform or asset.