Cryptocurrency firm Bakkt is expanding its custody services, supporting six new coins, including Dogecoin, Shiba Inu, USDC, Litecoin, Ethereum Classic, and Bitcoin Cash.

According to a November 15 announcement, cryptocurrency firm Bakkt appears to be returning to digital asset custody as its principal business, adding support for six new coins.

Bakkt will extend its custodial support to include Bitcoin Cash, Dogecoin, Ethereum Classic, Litecoin, Shiba Inu, USD Coin, and Bitcoin and Ether. Early in 2024, the organization anticipates adding coins to its custodial services.

Protecting cryptographic keys, essential for asset transfers and access is the primary concern of digital asset custody. Custodians, such as Bakkt, safeguard assets by implementing diverse security protocols. These protocols encompass multisignature technology, which necessitates multiple approvals for access and cold storage for currencies.

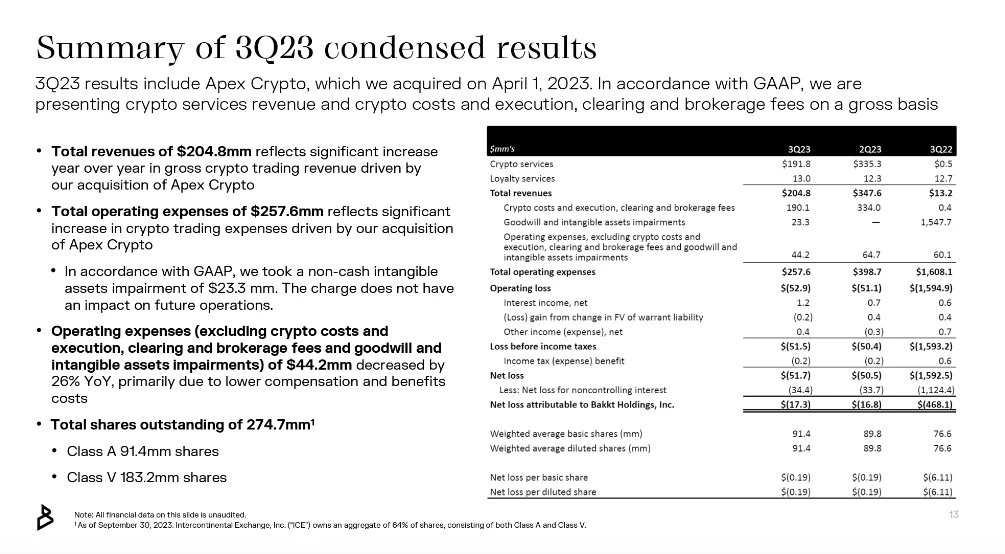

The announcement follows Bakkt’s November 14 publication of its quarterly earnings report, in which the company disclosed a reduced compensation and benefits expense resulting in an adjusted EBITDA loss (non-GAAP) of $21.6 million, a 30% decrease year-over-year.

Bakkt’s crypto revenue for the third quarter of 2023 amounted to $191.8 million, as per the report, due to the acquisition of Apex Crypto in April. The organization produced a cumulative revenue of $204.8 million during the specified period. Bakkt disclosed assets under custody totaling $505.7 million, reflecting a reduction of 28% compared to the previous year.

In addition to fortifying its crypto custody division, Bakkt is forming strategic alliances. According to its quarterly report, the company intends to provide clearing and custodial services for EDX Markets, a Wall Street-backed cryptocurrency exchange, beginning as a fallback qualified custodian.

LeboBTC, a cryptocurrency consulting firm for institutional investors, and Bitcoin platform Unchained are two new clients Utilizing Bakkt’s custodial services.

“The events of the past year have underscored the critical nature of qualified cryptocurrency custody,” Bakkt CEO Gavin Michael said in a statement.

Furthermore, Bakkt’s approach to attracting business-to-business consumers includes expanding custody services. The company announced in February that it would discontinue its 2021-launched consumer-facing application to concentrate on institutions during the crypto winter.

A considerable number of conventional financial institutions are also focusing on digital asset custody. The oldest bank in the United States, BNY Mellon, introduced a digital custody platform in 2022 to protect select customers’ ETH and BTC holdings. Earlier this month, DZ Bank, the third-largest bank in Germany, also began offering cryptocurrency custody to institutional investors.