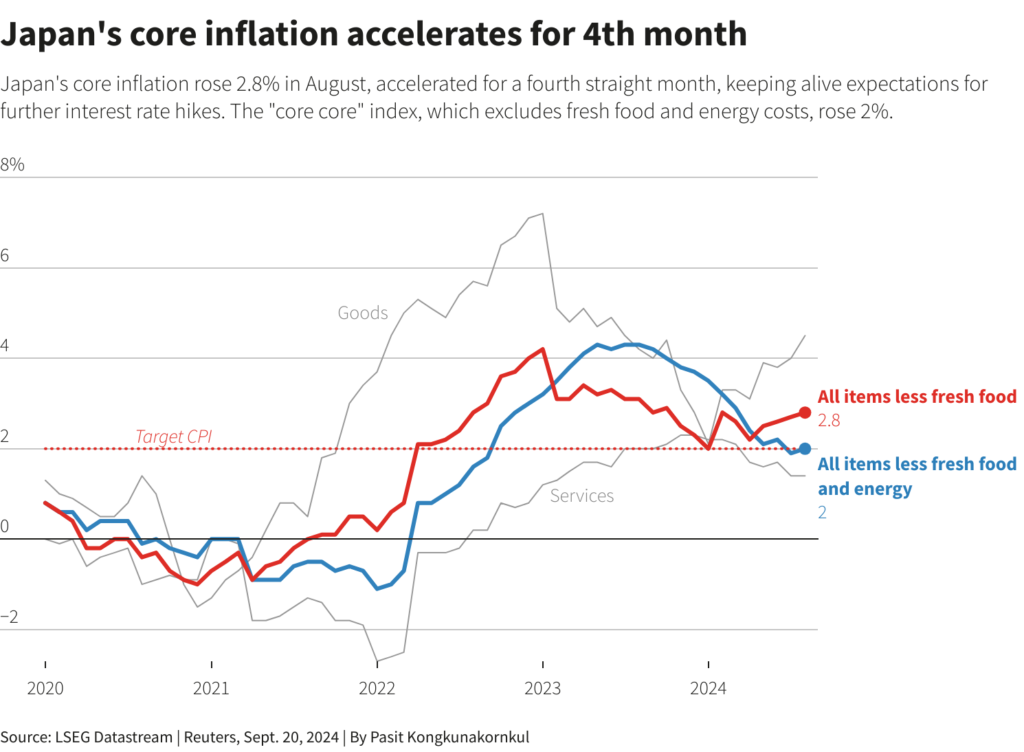

Core consumer inflation in Japan reached 2.8% in August, fueling speculation that the Bank of Japan may raise rates.

The Bank of Japan (BOJ) has decided to maintain interest rates at their current level of 0.25%, which is a significant macroeconomic event. This new discovery has increased the Nikkei index by 2.10 percent and 700 points today.

Additionally, concerns about the further unwinding of the Yen carry trade have subsided, demonstrating the resilience and upward movement of Bitcoin and alternative cryptocurrencies.

Bank of Japan on Future Rate Hikes

The Japanese central bank has updated its assessment of consumption as part of the most recent policy update. As a result, it demonstrated confidence in a robust economic recovery, which would make it possible for the central bank to hike interest rates once more in the months to come.

Private consumption has been on a moderately increasing trend despite the impact of price rises and other factors,” the BOJ stated in a statement, “despite the fact that there have been other factors.

“Amidst the global economic instability, markets closely monitor Governor Kazuo Ueda’s plans for future rate hikes from the Bank of Japan. Furthermore, the exceptional rate hikes implemented by the Bank of Japan this year have intensified concerns about the unwinding of the yen carry trade and the rise of the Japanese yen.

The Japanese central bank decided to stop implementing negative interest rates in the beginning of March, marking a departure from the decade-long stimulus package it had implemented to boost inflation.

During the final month of August, the core consumer inflation rate reached 2.8%, marking the fourth consecutive month that it has increased. Ueda stated that the Bank of Japan will proceed with its rate hike if inflation remains on track to meet its target of 2%.

Bitcoin and Altcoin Rally Ahead?

Reuters recently published research indicating that most analysts expect the Bank of Japan to hike interest rates in December. Because the Bank of Japan has maintained the status quo regarding interest rates, risk-on assets such as cryptocurrencies are experiencing a positive trend.

Bitcoin’s price increased by three percent, bringing it even closer to the $64,000 mark. On the other hand, alternative cryptocurrencies, led by Ethereum, have seen rises ranging from 4 to 10 percent.

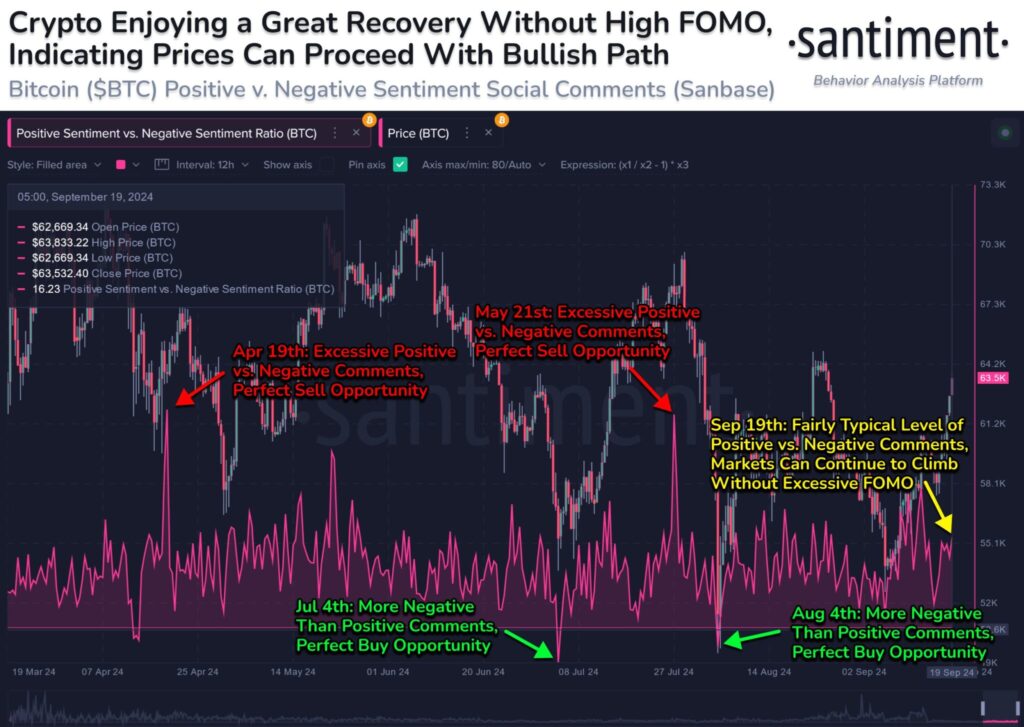

Following the Federal Reserve’s decision to reduce interest rates earlier this week, Bitcoin has been exhibiting signs of strength for the first time in almost four years. This robust comeback has occurred without any significant fear of missing out (FOMO), according to the data provided by Sanitment.

This demonstrates that the recovery of the Bitcoin and altcoin markets is robust and has the potential to continue going even further. Furthermore, the price of Ethereum appears to be recovering on the technical chart, as evidenced by the recent increase.

Despite the fact that Vitalik Buterin’s address has just moved to ETH, the chart that follows demonstrates a robust rebound that has the ability to bring the price up to $5,000.