On May 27, Based Doge (BOGE) platform on the Base network was attacked by a hacker who minted 91 million BOGE tokens and crashed its price.

The team has confirmed that May 27 saw an exploitation of the Memecoin protocol Based Doge (BOGE) on the Base network. The team stated that the attack was “identical to Normie,” which suggests that the perpetrator capitalized on a vulnerability comparable to the one that led to the recent Normie exploit.

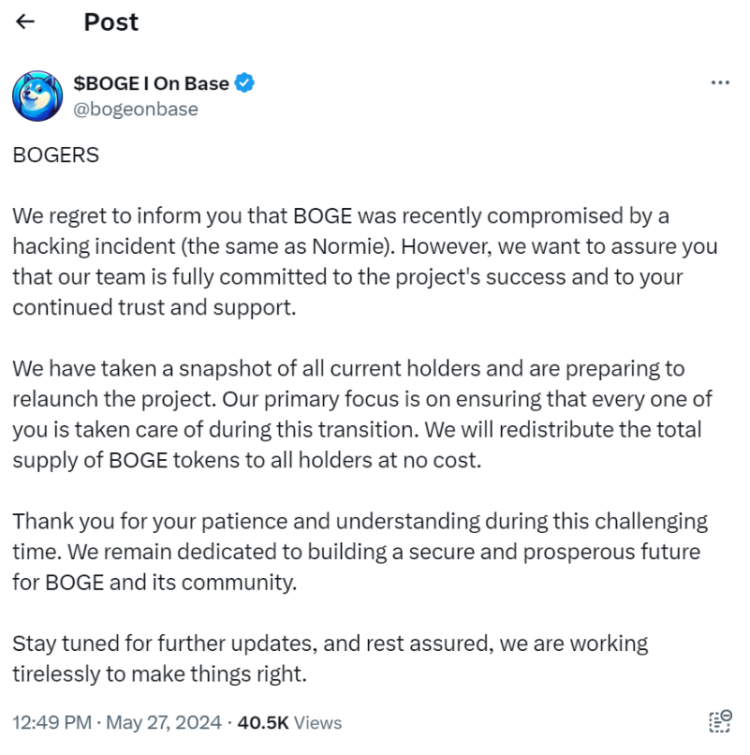

“We regret to inform you that BOGE was recently compromised by a hacking incident (the same as Normie),” the team wrote regarding the attack on X.

The exploitation of Normie occurred the day before the Based Doge attack, on May 26.

The Doge meme serves as the inspiration for the memecoin-based Doge. A nonfungible token accumulation is on the horizon, in addition to the Web3 video game “FlappyBoge,” which has already been released.

The post states that the team will relaunch the project after taking a snapshot of the current token balances to compensate all attack victims.

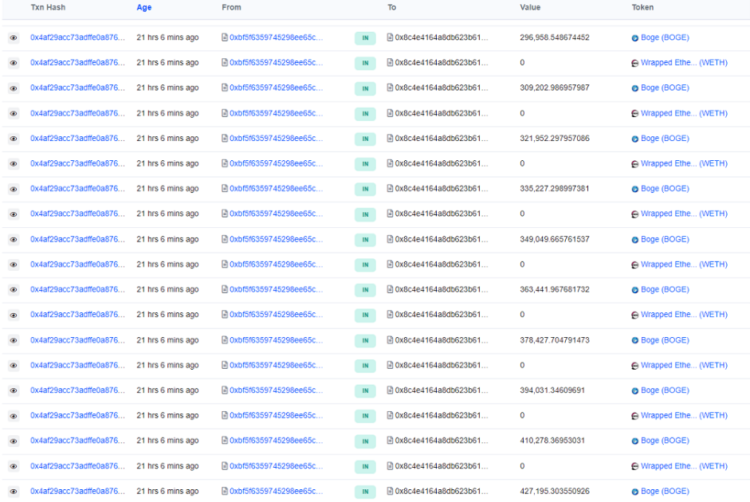

According to blockchain data, an account ending in bAOC initiated more than 120 transactions on Base at 5:48 pm UTC on May 27. Every individual transaction led to the deposit of hundreds of thousands of BOGE into the account, for an approximate cumulative amount of 91.4 million BOGE.

During each transaction, the perpetrator invoked an unverified function (Azure Contract: 1a42-ending Address). As a result of the unverified contract, the function’s code is not legible by humans.

The perpetrator promptly exchanged the 91.4 million BOGE for an estimated 4.47 Ether, with a current value of around $16,926.

While the attacker’s gain was relatively modest, the repercussions on the price of BOGE were significantly more substantial. CoinMarketCap reports that before the assault, the cost of BOGE was $0.002983, and the total supply was 1 billion. This indicated an estimated market capitalization of $2.9 million.

This indicates that the 1 billion coins that existed before the assault lost value of over $2.8 million, and the price plummeted to 0.000072 as soon as the attack occurred.

In an analysis, Neptune Mutual, a Web3 insurance provider, concluded that a flawed “get_premarket_user” function was responsible for the previous Normie attack.

This feature allowed premarket users to generate new tokens provided their balance matched the deployer wallet’s balance. By exchanging tokens until their balance matched that of the deployer wallet, the assailant obtained “privileged user” status and the ability to generate new tokens.

After gaining minting authority, they minted more than 170,000 Normie tokens and sold them on the market, resulting in losses exceeding $800,000.

Exploits of smart contracts continue to endanger cryptocurrency users. An adversary emptied the DeFi protocol Sonne Finance of $20 million on May 17.

An ex-employee of the Solana memecoin platform Pump. Fun allegedly utilized privileged access the same day to exploit the protocol. The alleged assailant asserted that U.K. authorities had detained him about the incident.