Based Rollups, according to some critics, align incentives between Ethereum layer 2 and its base layer validators, perhaps resulting in deflationary issuance again.

Based Rollups might offer a solution to Ethereum’s layer-2 networks diverting liquidity and revenue from its base layer.

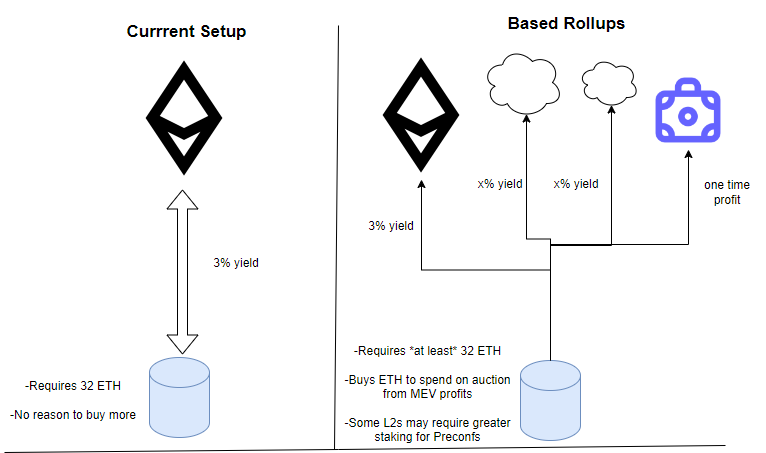

These rollups, which rely on Ethereum’s layer-1 validators for processing instead of their own sequencers, could “directly impact the monetization of Ethereum by making a pretty fundamental change to incentive structures,” according to Cinneamhain Ventures partner Adam Cochran in a Sept. 10 X post.

He suggested this could potentially boost long-term Ether demand by a hundredfold.

Validators can choose to process Based Rollups, earning additional rewards, which could raise the value of staking ETH and result in higher yields.

Cochran also mentioned that Based Rollups could be interoperable with other rollups, enhancing liquidity access, cross-chain settlements, and overall demand for gas fees.

This alignment of incentives between layer-2 networks and layer-1 validators could eventually allow for zero inflation in ETH issuance while maintaining high staking yields.

Cochran emphasized that this would mark the first time staking incentives are driven by Ethereum Virtual Machine (EVM) usage rather than ETH issuance rates, noting, “That fundamental separation is the kind of thing that puts $100k ETH on the table within the next decade.”

Though Based Rollups aren’t a new concept, they were highlighted in 2023 by Ethereum developer Justin Drake, who noted their strong economic alignment with their base layer (L1).

Ethereum’s issuance turned inflationary in April following the Dencun upgrade, which reduced layer-2 fees and decreased overall gas (ETH) usage.

This reduced the amount of ETH burned, leading to lower network revenue and inflationary issuance.

In response to concerns, Ethereum community member Ryan Berckmans stated in a Sept. 10 X post: “If total fees stay low forever, then the whole world can use Ethereum for dirt cheap and this would further turbocharge adoption of ETH as money.”

He concluded that Ethereum’s continued growth supports a bullish outlook for ETH regardless of fee levels.

This aligns to restructure network economics to benefit ETH holders through Based Rollups.

Ethereum developer Eric Connor echoed these sentiments in a Sept. 10 X post, stating, “Ethereum is in the best spot it’s ever been, yet sentiment is the worst it’s ever been.”

He added, “The future of crypto will not be won on Crypto Twitter. It will be won by delivering a decentralized, global financial settlement layer for the world, where ETH gains a natural monetary premium.”