Bhutan’s government recently moved 367 Bitcoin ($33M) to Binance, likely for profit, following a $66M sale two weeks earlier.

With the intention of selling off some of its Bitcoin assets, the government of Bhutan transferred some of its holdings to the Binance market. Taking this action comes in the midst of the recent meteoric rise in the price of Bitcoin, which suggests that the government may be merely looking to secure profits.

Bhutan Sells $33 Million Worth Of Bitcoin

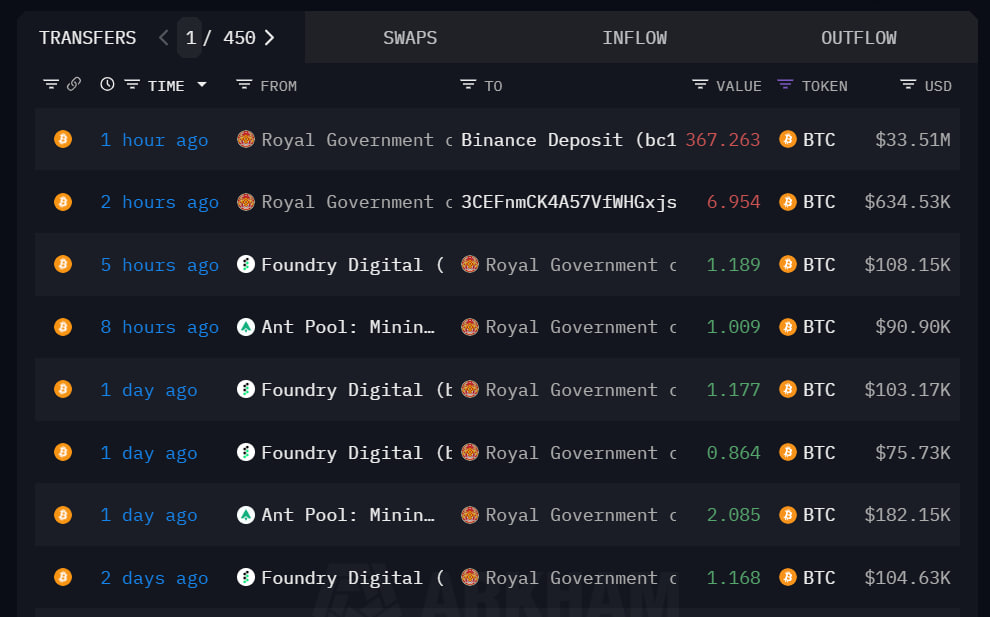

Arkham Intelligence provided information that the Royal Government of Bhutan transferred a little more than 367 BTC (about 33 million dollars) to the Binance exchange today.

This suggests that the government sold off these coins, potentially as a profit-taking move, following the recent increase in the price of Bitcoin. Two weeks prior, the authorities had taken a similar action, successfully selling $66 million worth of Bitcoin through the leading exchange.

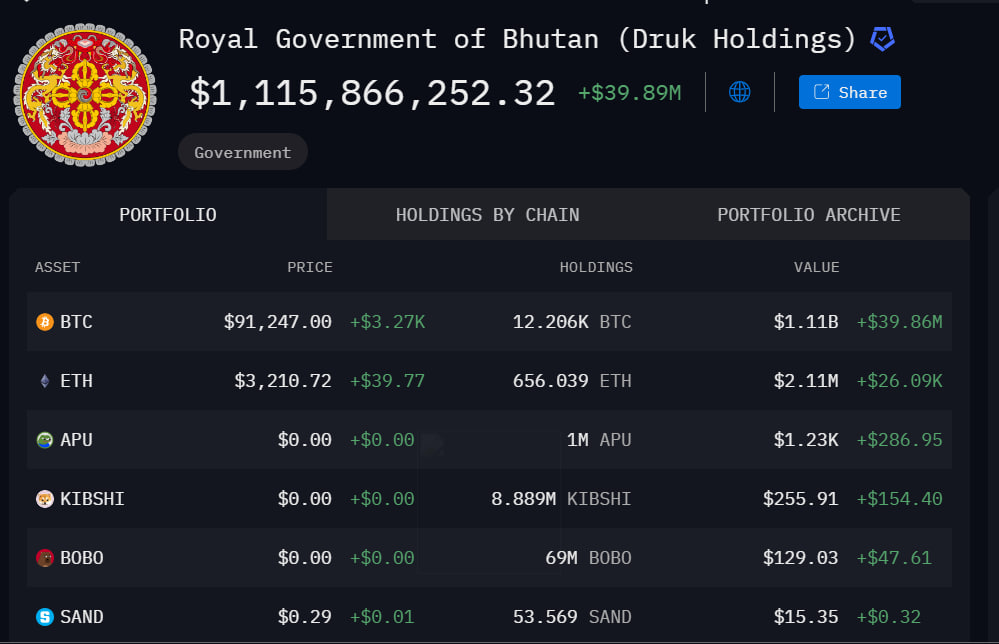

At that time, they sold those coins just as the price of Bitcoin surged to over $70,000.On-chain data reveals that Bhutan is still in possession of 12,206 Bitcoins, which is equivalent to $1.11 billion.

It is possible that Bhutan would sell these Bitcoins as the price of Bitcoin continues to rise during this bull run. Since Donald Trump, a proponent of cryptocurrency, won the election, Bitcoin has experienced a meteoric rise in value.

Because of this, some people believe that the flagship cryptocurrency might reach $100,000 by the end of the year. It is interesting to note that under the administration of Donald Trump, the United States appears to be on the verge of matching Bhutan’s aggressive strategy to accumulate the flagship cryptocurrency.

Despite being the largest Bitcoin holder among governments, the United States has acquired its Bitcoin holdings through seizures, not through active coin accumulation.

On the other hand, Trump has pledged to establish a strategic bitcoin reserve by utilizing these additional bitcoins. Senator Cynthia Lummis, who is a supporter of cryptocurrencies, has introduced a bill that would enable the United States to buy one million bitcoins on an annual basis over the next five years.

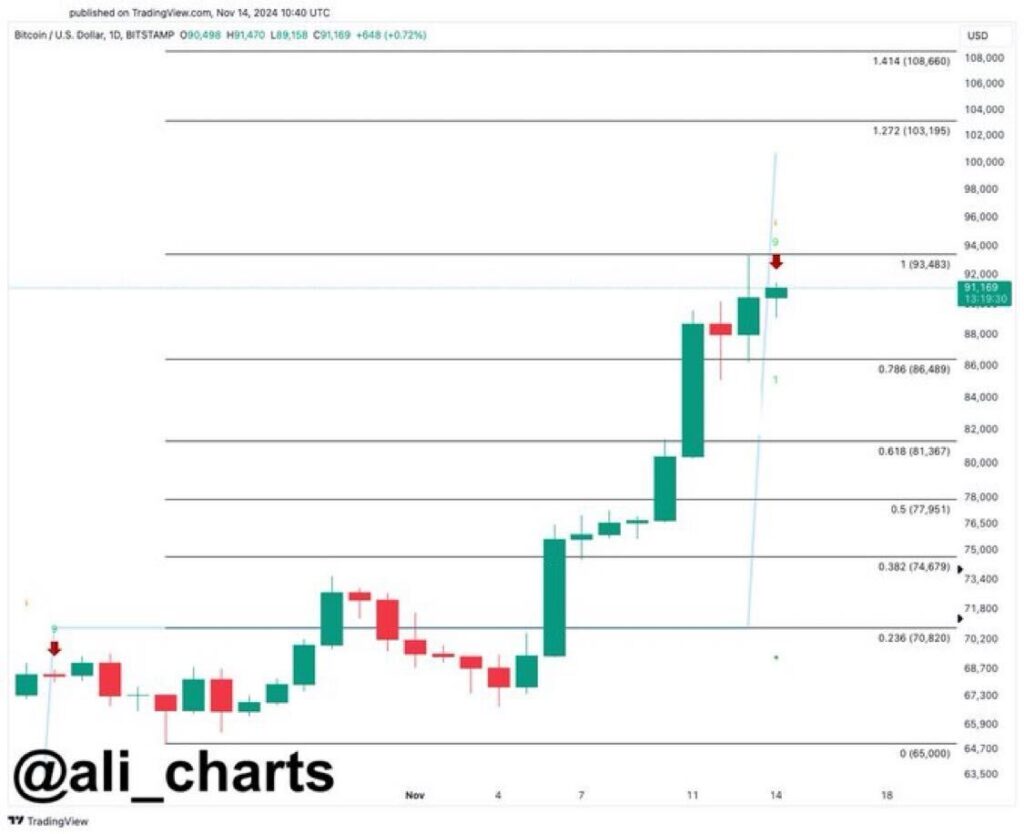

The recent increase in the price of Bitcoin in Bhutan illustrates how certain investors may be securing profits. This could lead to significant selling pressure on the flagship cryptocurrency, potentially resulting in a short-term price decline.

Additionally, cryptocurrency analyst Ali Martinez put up the idea that a price correction was on the horizon. Given that the TD Sequential indicator is currently displaying a sell signal on the daily chart, the analyst has suggested in a post on X that a potential correction in the price of Bitcoin may be underway.

As a result, Bitcoin is running the risk of falling below $90,000. Having said that, it is important to point out that, although some whales, like in Bhutan, are selling off their coins, others are still amassing them in preparation for the subsequent leg of the bull run. Martinez revealed data from Santiment, which showed that Bitcoin whales had acquired over 100,000 BTC in the past week.