Following its 24th quarterly burn, Binance destroyed 1,99 million BNB tokens. The Auto-Burn system executes this burn to maintain the 100,000,000 BNB token supply. The market value of the burnt tokens is $484,160,000.

This is a Binance initiative to reduce the number of BNB tokens circulating. The burn is carried out by an Auto-Burn mechanism, which determines the amount of BNB to destroy based on the price and the number of blocks generated on the BNB Smart Chain. In total, the exchange has destroyed 48 million BNB tokens.

BNB Quarterly Burn

BNB was introduced in 2017, and a pledge was made to destroy 100 million BNBs (or 50 percent of its supply) by burning them. Consequently, only 100 million BNB will remain in circulation in the future.

This commitment is automatically executed each quarter, with the quantity determined by the Auto-Burn algorithm.

The BNB Auto-Burn provides a method that can be independently and objectively audited. The technique is distinct from the centralized Binance exchange, and quarterly data is provided. Binance stated in a blog that BNB Chain continues to use the Real-Time-eliminate mechanism to eliminate a portion of its gas costs in real-time.

According to the BNB burn site, the next burn will eradicate approximately 2,093,457 BNB. However, current data suggests that the price of BNB tokens will increase substantially more during the quarter 25 token fire.

On April 14, 2,020,132.25 BNB tokens worth $542 million were incinerated as part of Binance’s 23rd quarterly BNB burn.

What Does the Burn Mean for BNB?

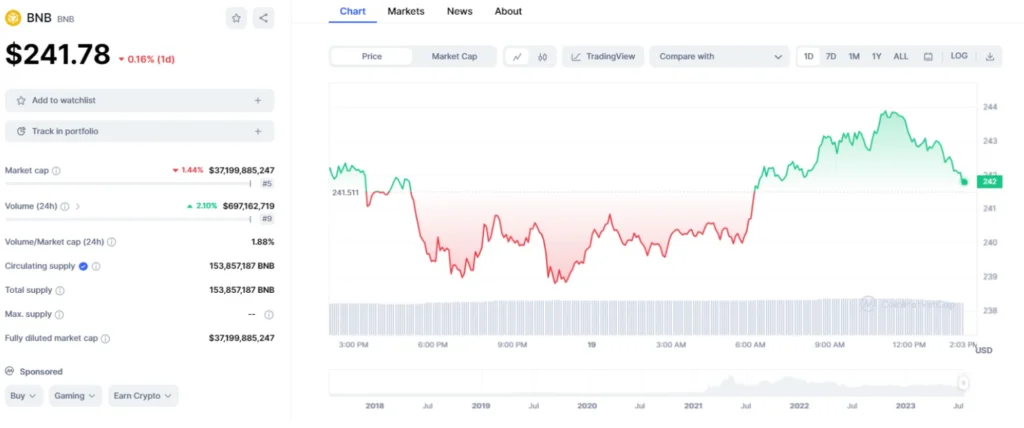

After Binance destroys its BNB tokens every quarter, bullish price movements are anticipated. However, this was not the case this time. The current price of BNB is $242.22, an increase of just 0.41 percent from the previous day.

This slight BNB price recovery also followed last week’s sharp 25% decline, caused by the SEC lawsuit against Binance, in which BNB was referred to as an “unregistered security.”

Near $220 provided consistent support for the BNB price. If past performance is any indication, this level should provide an excellent buying opportunity following the SEC-led price decline.