CZ believed the incident was terrible for the industry because one of the top cryptocurrency businesses collapsed over night.

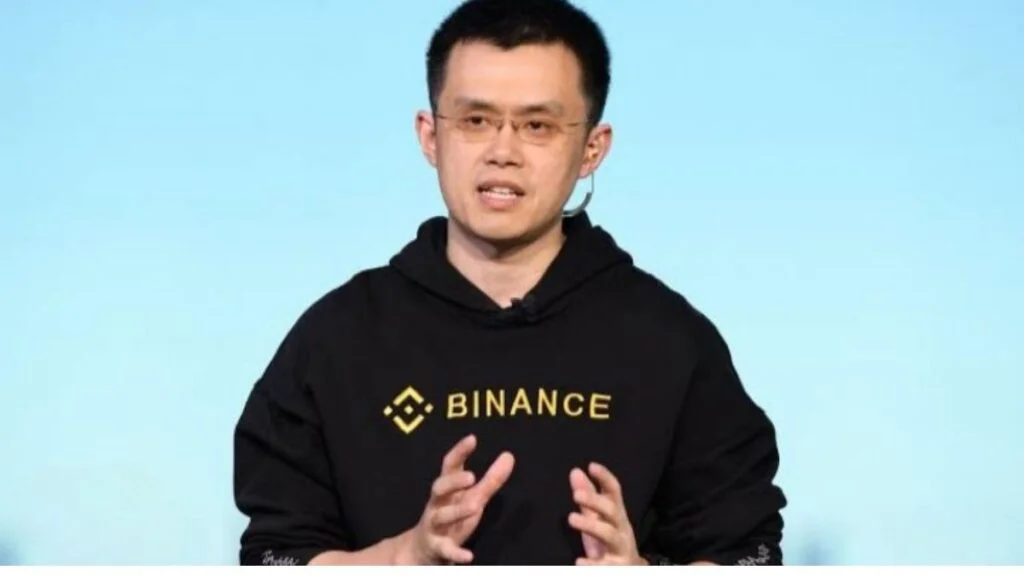

In 2022, cryptocurrency exchange FTX declared bankruptcy alongside numerous other failed projects, such as Terra (LUNA), 3AC, Celsius, and Voyager. Changpeng “CZ” Zhao, the CEO of Binance, the largest cryptocurrency exchange, predicts a period of increased regulatory scrutiny in the near future due to the devastation wrought by the multi-billion dollar losses suffered by investors and businesses.

CZ thought the incident, which saw one of the biggest cryptocurrency businesses collapse over night, was disastrous for the sector and significantly damaged consumer confidence. He said this while speaking at the Indonesia Fintech Summit in 2022:

“I think basically we’ve been set back a few years now. Regulators rightfully will scrutinize this industry much, much harder, which is probably a good thing, to be honest.”

Historically, Know Your Customer (KYC) and anti-money laundering regulations dominated the cryptosphere (AML). CZ repeated his steadfast opinion that laws must put an emphasis on exchange operations, including business plans and evidence of reserves. He therefore thought that increased regulatory scrutiny of crypto company operations is imminent.

Retail investors will undoubtedly be impacted by FTX’s collapse in the short term, but conversations about how to manage risks in various crypto ecosystems will benefit in the long run. In reference to FTX particularly, he said:

“The last three days is just a revelation of problems. The problems were there way longer. This problem wasn’t created in the last three days.”

Alameda Research’s financial statements, which were stuffed with FTX Tokens, FTT ($2.07), were the biggest red flag about FTX, according to CZ that led him to decide to sell Binance’s FTT holdings, which were worth more than $2 billion at the time.

Sam Bankman-Fried, the CEO of FTX, contacted CZ the following day with a proposal that “did not make sense from a number of fronts.” CZ simultaneously hoped to secure an over-the-counter (OTC) agreement for user protection:

“Original intention was let’s save the users, but then the news of misappropriating user funds, especially U.S Regulatory Agencies investigations (made us realize) we can’t touch that anymore.”

The industry will become lot healthier, in CZ’s opinion, if transparency is increased and regulatory agencies are made aware of crypto audits and cold wallet data. Finding the ideal ratio of regulations is not difficult, he claimed.

The businessman emphasized the necessity for simple tools for storing private keys and other security features, but he contended that the crypto ecosystem will develop more gradually than dramatically.

In an effort to gain back investor trust, Binance created a new page called “Proof of Assets” that provides information on the exchange’s on-chain activity for both its hot and cold wallet addresses. “Our objective is to allow users of our platform to be aware and make informed decisions that are aligned with their financial goals,” said Binance in an official statement.