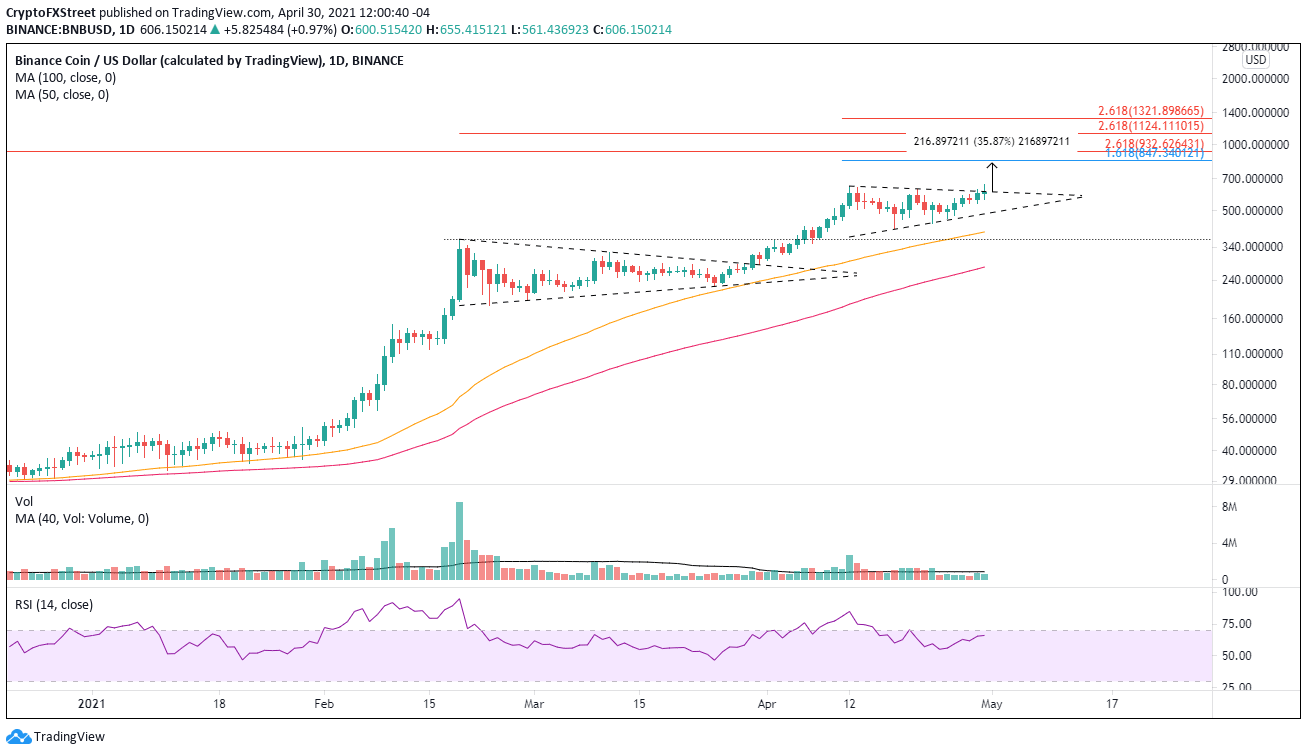

Binance Coin price forecasts a 35% change from the symmetrical trigger price for a symmetrical triangle. The first attempt to erupt today has proven indecisive, allowing BNB to revert to the trend.

Coin price at speed 4 since 2017 for the fourth-best month

A month for the cryptocurrency industry was a spellbinding month in April with many falls of 50 per cent. The collective sale also dropped BNB, but its relatively high output was impressive and paved the way for today’s breakup.

The price for the Binancing Coin is currently up 99.71% for April and represents the fourth-highest monthly return ever since July 2017. The Altcoin is still ready to end the week by 20%. The figures show enormous relative strength and spot BNB as the industry leader in cryptocurrencies, if the broad recovery persists.

Currently, CoinMarketCap displays a $92 billion BNB market capital, the third biggest cryptocurrency, that it will be throughout the spotlight.The digital token has quietly delineated a symmetrical triangle pattern of just above 35%, with a price of $847.25 as compared to the current position of the highest trend line of the triangle. The target is closely correlated with Fibonacci’s 161.8% April extension, which fell to 827.48 dollars.

On April 12, at $ 643.37, some terrible resistance was offered earlier today and remains the critical obstacle for the price of the Binance Coin to the measured movement target. Besides $827.48, the 261.8 percent extension of the bear market to $932.62 is necessary for the speculators.

The 261.8% extension of the crash in February could target big game hunters at 1.124.11 USD.

Crypto Space recalled the need for sound risk management preparedness for market players during February and April. If the disruption fails, funding will be reversed. The triangle’s lower trend is starting with critical support for $484.68, the average of just 50 days is $399.35 and the peak of February at $368.17.

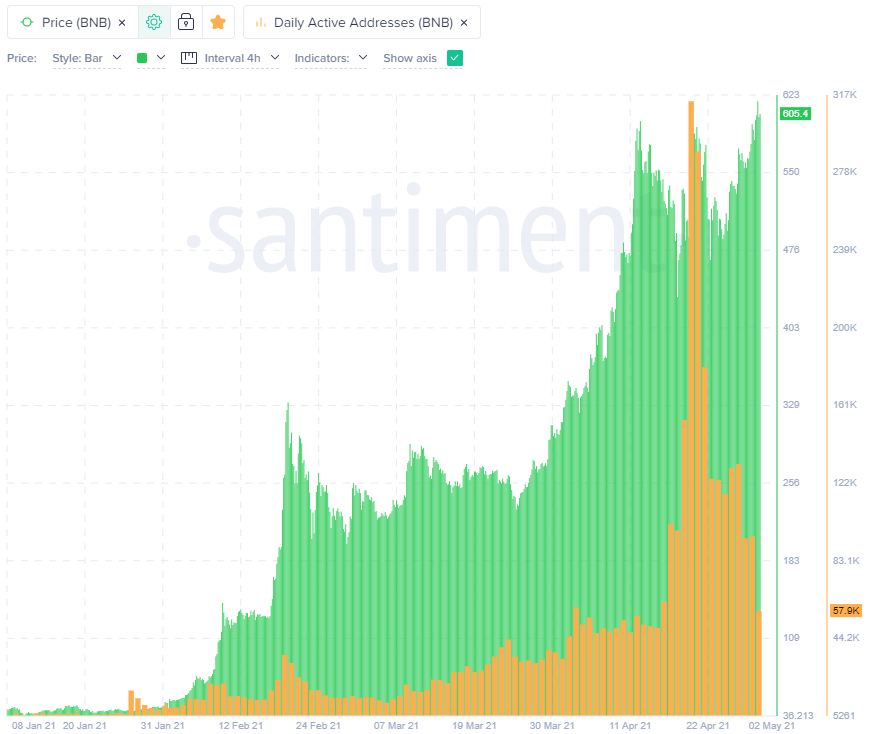

The number of regular active addresses fell from the peak of 313,4K on April 20 to 57,9K as of today, which represents an 80% decline to substantiate the value of sound risk management in any investment approach. A bizarre trend in the face of BNB being an ever-high door.

The dramatic drop in BNB-network addresses shows a widespread migration of speculators through benefit or simply by re-allocating funds. In addition, it means that the price of Binance Coin can need to be reinstated inside the triangle prior to a durable breakdown.

The technological proofs reinforce a bullish BNB views, but the frequent successful adress metric gives warning about the intentions of the altcoin in the future.