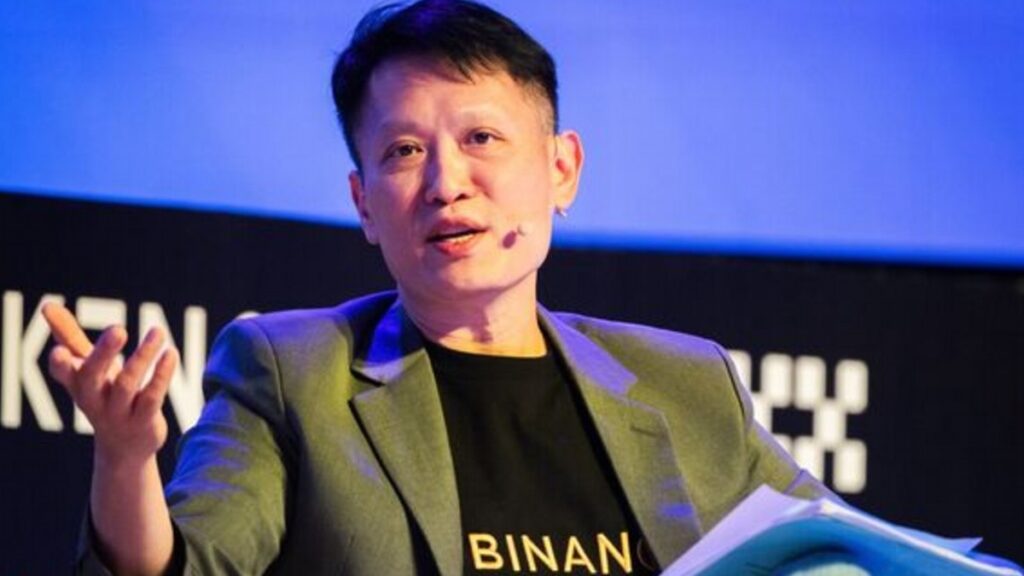

Richard Teng has been named CEO of Binance Exchange, as the cryptocurrency trading company navigates the market without CZ.

Changpeng “CZ” Zhao, the co-founder and former CEO of Binance Exchange, has nominated Richard Teng, the company’s previous Head of Regional Markets, to take over as CEO during what may be considered the most important week for Binance Exchange and the larger crypto ecosystem.

Nearly no analyst anticipated this until this week, when news leaked that the US Department of Justice had settled for $4.3 billion with the exchange. Teng still has a lot of obstacles to overcome until the CZ era ends to complete the transaction.

Binance was accused of facilitating transactions for ISIS, Al Qaeda, and other terrorist groups until 2022, when the DOJ’s investigations intensified. US Attorney General Merrick Garland, Treasury Secretary Janet Yellen, and Chairman of the Commodity Futures Trading Commission (CFTC) Rostin Behnam were among the attendees of the live broadcast from US regulators.

Although a settlement has been reached and CZ has resigned, the regulators stated that Binance must file the report on suspicious activity and provide its records for additional investigation as part of the agreement.

Richard Teng will be primarily responsible for this and will be prepared to threaten more penalties if he doesn’t follow through on all the terms.

Rebuilding trust in the exchange will also be a problem for Richard Teng, despite CoinMarketCap statistics indicating that the trading platform continues to hold the top spot as the largest exchange with a trade volume of about $12.6 billion.

Implication for Other Exchanges

The $4.3 billion deal is considered one of the largest corporate settlements in US history, making it possibly the biggest victory for US regulators thus far this year.

Regulators may have pushed for settlement as a quick win against most crypto firms, even though the United States Securities and Exchange Commission (SEC), which also has an ongoing complaint against Binance, was not included in the settlement.

The SEC’s new action against Kraken Exchange is the next well-known case that goes unnoticed. This is the second lawsuit the company has faced this year, and the exchange has made it clear that it is prepared to battle rather than accept the first settlement offer it accepted earlier in the year.