According to Kaiko, cryptocurrency exchange Binance increased its listing requirements after a 21% drop in the number of listed trade instruments in 2023.

A recent report by Diving Into DEXs claims that Binance is now delisting companies more quickly after Changpeng Zhao, the company’s founder and former CEO, settled a $4.3 billion lawsuit with US regulators for, among other things, running an unlicensed exchange.

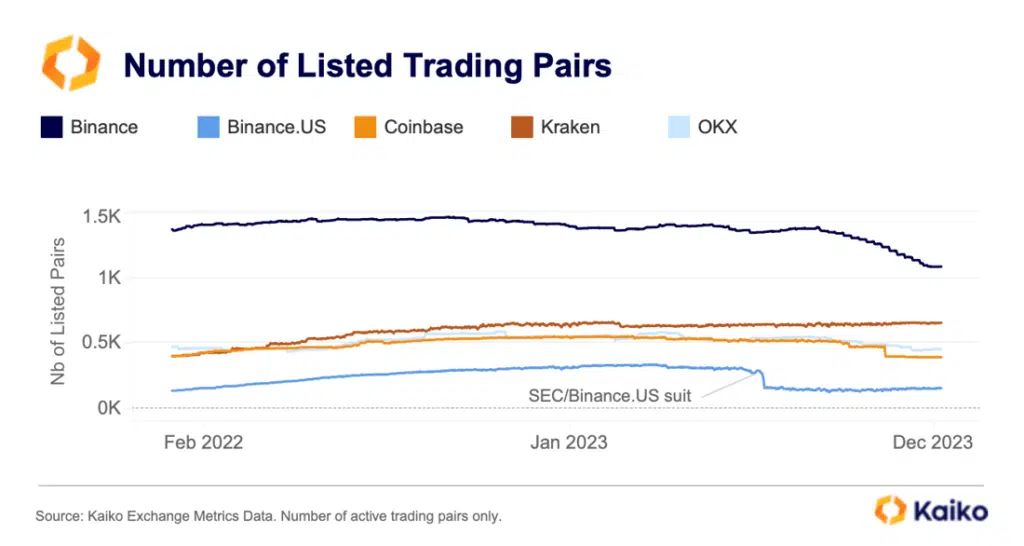

Analysts at Kaiko acknowledged that Coinbase and OKX had delisted several instruments, so Binance was one of many cryptocurrency exchanges in 2023 to reduce the number of instruments it offered for listing.

However, according to Kaiko statistics, the cryptocurrency exchange Kraken, based in the United States, has boosted the number of cryptocurrencies it supports by a small amount.

Over 3,445 tokens or trading pairs have been delisted or made inactive on major trading platforms, according to a study released by Kaiko in mid-October 2023.

This is a 15% increase in delisted instruments compared to the same period in 2022. According to analysts at Kaiko, as of October 2023, Coinbase had withdrawn 80 trading pairs, increasing the total number of delisted instruments from its platform to 176 in 2023.

Early in December 2023, Richard Teng, the recently hired CEO of Binance, admitted to that the exchange’s first compliance control was “inadequate” and that “mistakes were made.”

The U.S. Department of Justice claimed that Binance employees “knew that the company’s anti-money laundering procedures were inadequate and would attract criminals to the platform,” which prompted him to make these remarks.