Binance exchange has continued to lose market share due to ongoing regulatory issues in the United States, with evidence in spot trading volume reportedly declining 7 months in a row.

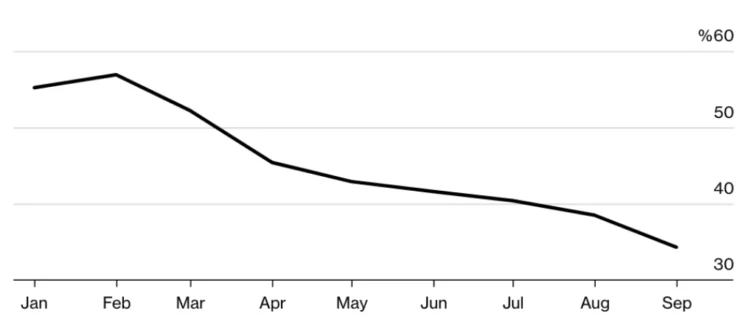

Binance’s spot market share declined for the seventh consecutive month in September 2023, Bloomberg reported on October 5, citing CCData’s analysis.

According to the report, Binance’s spot market share decreased from 38.5% in August to 34.3% in September. In January 2023, Binance’s proportion of the spot market reached 55.2%.

Binance has also been losing market share in the derivatives and spot markets. According to the report, Binance’s market share for derivatives decreased from 53.5% in August to 51.1% in September. In January, the exchange’s market dominance in the derivatives market comprised over 62%.

Jacob Joseph, a research analyst at CCData, asserts that Binance’s regulatory issues in the United States are only one of the reasons the exchange has lost market share. The analyst believes the decline is also attributable to Binance’s decision to discontinue its no-fee trading promotion for significant trading pairs.

Binance’s decline in market share has also coincided with the conclusion of services in several of its major markets this year. In September, Binance announced its complete withdrawal from the Russian market, transferring its entire local business to the newly launched CommEx exchange founded by unknown entities. Russia was one of Binance’s largest markets, with Russian visitors comprising roughly 7 percent of the platform’s traffic.

Early in September, Binance modified its trading fees by reapplying a standard taker charge based on the VIP status of the user. For instance, Binance began charging a 0.1% taker fee on spot and margin transactions made by regular users.

According to the report, Binance’s lost spot trading volume has been allocated to exchanges such as HTX (formerly Huobi), Bybit, and DigiFinex. According to reports, rival exchanges such as OKX, Bybit, and Bitget have gained market share in derivatives.