Binance reportedly stated that they were aggregating user wallets to guarantee the security of user funds.

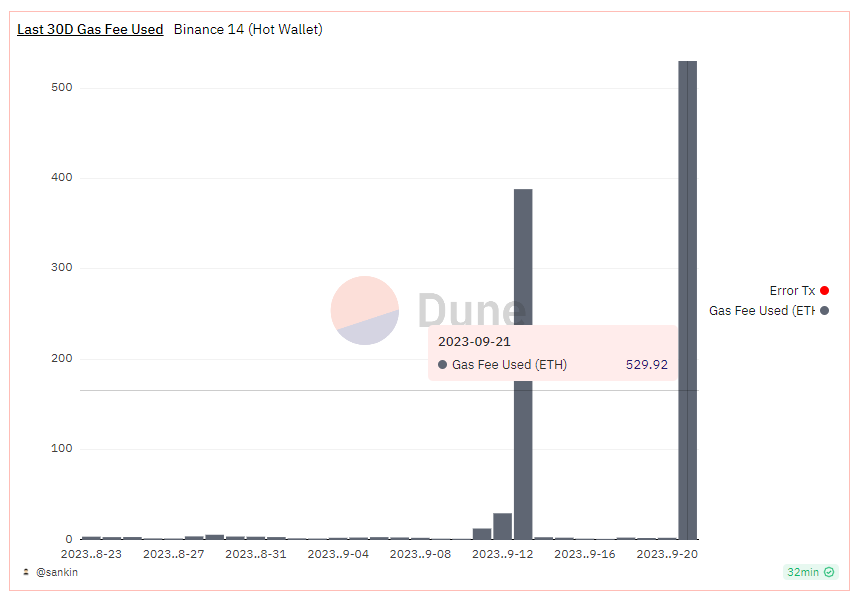

A Binance-affiliated cryptocurrency wallet has expended 530 Ether. Etherscan, a blockchain data explorer, reports that approximately $843,797 in gas fees were paid in 24 hours.

On September 21, gas fees on the Ethereum network increased from a minimum of 6 gwei (approximately $0.17) per transaction to a maximum of 332 gwei (roughly $11.2). The increase in gas pricing was attributed to “Binance 14,” a wallet belonging to Binance that spent nearly $1 million on ETH network gas prices.

Community members voiced their opinions on the exchange’s astronomically high petroleum costs. Belinda Zhou, an investor in Web3, referred to Binance engineers as “incompetent” and stated that they had incorrectly configured the gas allowance.

Adam Cochran, a partner at the venture capital firm, Cinneamhain Ventures, believes that the atypical gas fees resulted from substandard APIs. The executive criticized the exchange’s technology and questioned its capacity to keep “hundreds of billions in coins across multiple protocols” secure.

In the meantime, Binance reportedly stated that they aggregated wallets when gas fees were low to guarantee the security of user funds.

As a result of its ongoing legal conflict with the United States Securities and Exchange Commission, the exchange has constantly been on the radar of critics.

On September 21, the CEO of the cryptocurrency exchange, Changpeng Zhao, refuted a report that he borrowed $250 million from BAM Management, the holding company of the exchange’s U.S. counterpart. According to Zhao, he was the one who loaned the money to the business.