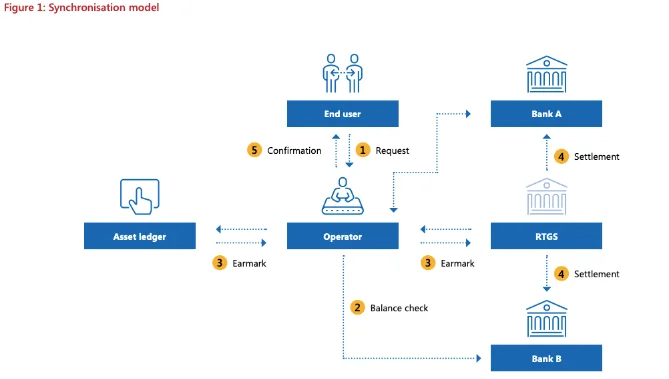

The Bank of England (BoE) and the Bank for International Settlements (BIS) have concluded pilot testing for a system for inter-institutional settlements driven by distributed ledger technology known as Project Meridian.

A report on the joint experiment Meridian pilot experiment with the Bank of England was released by BIS on April 19. The 44-page report claims that the banks have successfully used distributed ledger technology (DLT)’s synchronization network to buy homes in Wales and England.

According to the research, the API-enabled communications delivered between the synchronization network and RTGS system offer a general interface that can be “relatively easily” expanded to include other asset classes, such as foreign currency. This can speed up transactions and cut down on their expenses and dangers.

Project Meridian aims to offer a framework for central bank digital currency (CBDC) settlement. The study is precise when listing the potential advantages of central banks:

“Synchronization can provide a catalyst for innovation in wholesale payments and support the emergence of new payments infrastructures that settle using central bank money.”

The “Political and operational considerations” section of the report concludes with several reservations about the system’s potential application. Future network administrators must consider things like identity verification’s technical aspects.

Additionally, when many jurisdictions are considering extending the running hours of their national payment infrastructures, the synchronization services would be constrained by the current RTGS operating hours.

The system’s implementation would pose some legal issues, including the ultimate point of the settlement’s irrevocability, the digital representation of asset ownership, and the prevention of commercial banks’ arbitrary use of the customers’ funds before a transaction date.

Project Icebreaker, an investigation of international retail and remittance payment use cases for CBDCs with the central banks of Israel, Norway, and Sweden, was completed, the BIS stated in March.

After a month-long test that enabled $22 million in international transactions, the bank declared a CBDC pilot comprising the central banks of Hong Kong, Thailand, China, and the United Arab Emirates to be “successful” in October 2022.