The Bank of International Settlements and other European Central banks are developing an international cryptocurrency tracking system.

The Bank of International Settlements (BIS) has devised a proof of concept (PoC) for a system that can track on-chain and off-chain transactions from cryptocurrency exchanges and public blockchains, such as Bitcoin.

With the Deutsche Bundesbank, De Nederlandsche Bank, European Central Bank, and the Bank of France, BIS has announced a successful PoC called Project Atlas to gauge cryptocurrency markets’ macroeconomic relevance and decentralized finance (DeFi) protocols.

The BIS Innovation Hub published the concept that aims to provide insights, information, and economic implications of the sector, citing a lack of transparency and potential threats to financial stability exemplified by high-profile failures in the crypto-space, such as the Terra/LUNA algorithmic stablecoin collapse in 2022.

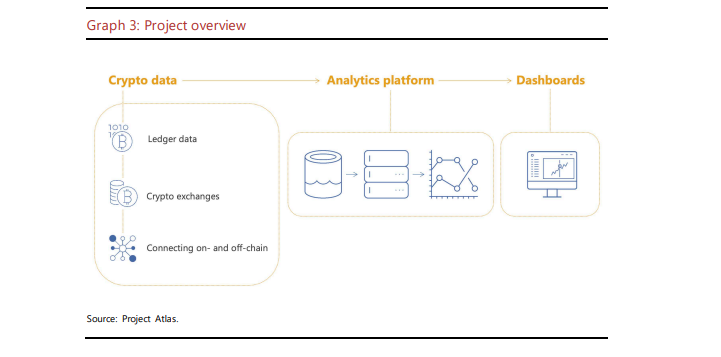

The initiative merges off-chain data from cryptocurrency exchanges with on-chain data gathered by nodes from public blockchains.

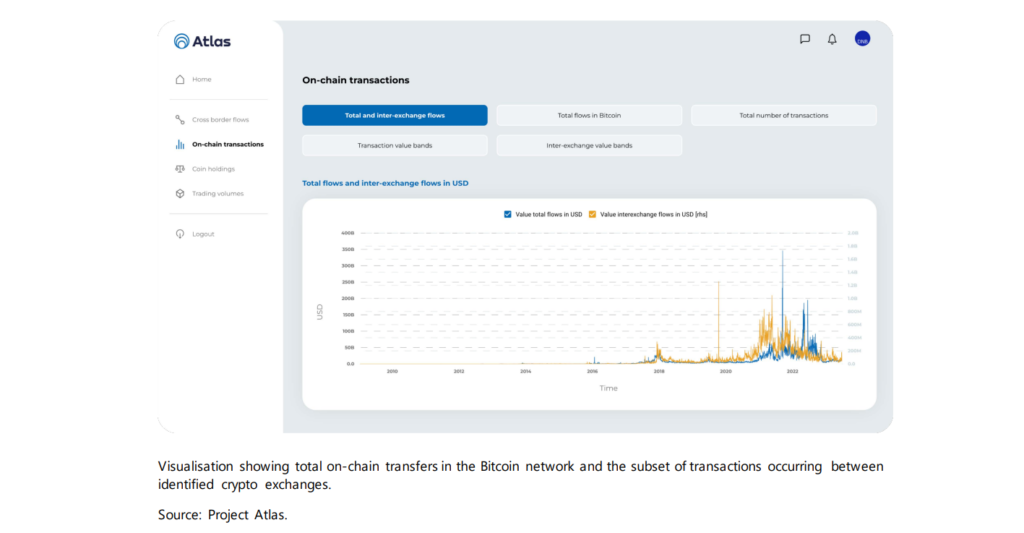

Project Atlas tracked cryptocurrency flows across geographies in the initial incarnation of the proof-of-concept.

The initial method employs Bitcoin network transactions attributed to centralized exchanges and the location of those exchanges as proxies for cross-border capital flows.

Given that the country of origin of exchanges is not readily discernible, the methodology observes that flows are likely lower-bound estimates of actual transaction volumes.

Despite this, the initial pilot for Project Atlas indicates that inter-exchanges are “significant and substantial economically.”

In its current incarnation, Project Atlas features a front end with dashboards that visualize the outcomes of data aggregation and analysis, such as on-chain transfers and global fund movement.

The PoC will provide an overview of cross-border transactions and a means for Central Banks to assess the relative economic significance of the cryptocurrency ecosystem in various jurisdictions.

“The data will allow flows to be analyzed structurally and the influence of price shocks, financial market developments and country characteristics on crypto flows to be investigated.”

In order to advance to the next chapter of development, the project will continue to incorporate more data sources while also extracting and analyzing data from Ethereum network nodes and implementing DeFi protocols.