Bitcoin academics have criticized an ECB paper that nearly labeled Bitcoin a Ponzi scheme, citing its negative portrayal of Bitcoin’s volatility and societal impact.

A paper released earlier this month by the European Central Bank that caused a lot of controversy almost called Bitcoin a Ponzi scheme. Now, a group of crypto experts has written a response paper that strongly disagrees with this paper.

The ECB study “shows Bitcoin’s instability, lack of usefulness, and wealth concentration as major flaws,” writes Dr. Murry Rudd, who writes for the Satoshi Action Fund and supports Bitcoin.

The response, which came out on Oct. 22, criticizes an ECB working paper from Oct. 12 by Ulrich Bindseil and Jürgen Schaaf that crypto supporters found very offensive.

Rudd said that the paper made a negative case for CBDCs as a better answer for modern financial systems while also criticizing Bitcoin’s long-term viability and effects on society.

ECB’s reasons are “fundamentally flawed.”

The authors of the ECB study made a lot of points, but Dr. Rudd said they got them wrong when they said Bitcoin’s main purpose changed from payments to investments, and they didn’t understand how its technology works, especially when it comes to proof-of-work and decentralization.

Rudd said, “By focusing on the early limitations, Bindseil and Schaff fail to acknowledge the significant progress made in making it more scalable and efficient.”

Rudd said that the paper from October 12 also made a number of important but mistaken points. For example, it said that Bitcoin’s wealth is concentrated in a few hands, but that didn’t take into account the fact that many big wallets are actually exchanges that hold funds for millions of users.

The ECB’s claims that Bitcoin doesn’t have any value on its own don’t take into account its use as a store of value or its network effects. Also, the asset’s volatility isn’t taken into account because it’s a normal part of early technology usage, he said.

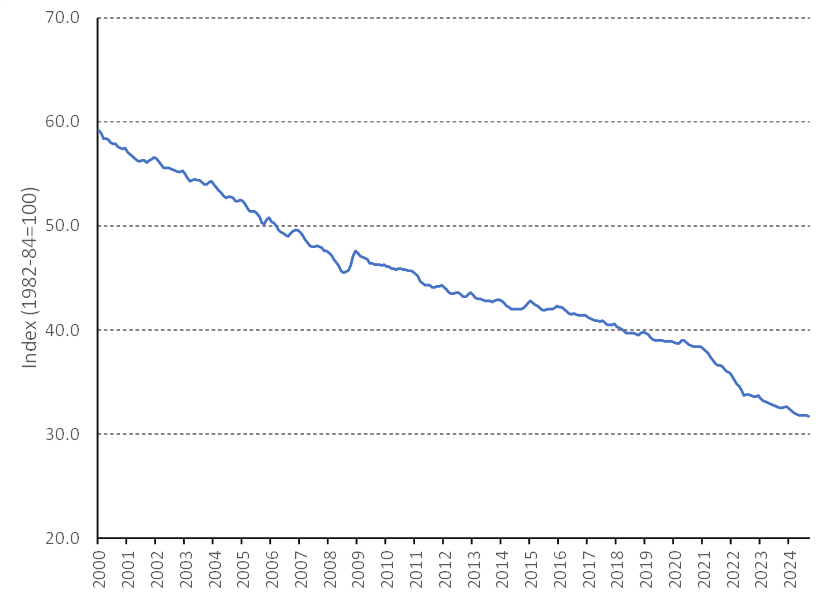

The ECB said that their criticism of Bitcoin’s wealth distribution also “fails to recognize the broader implications of inflation within traditional financial systems.” They used the falling value of the USD as an example.

In a Conflict of Interest

The response also points out that the writers are working on a central bank digital currency (CBDC), also known as the “digital euro,” for the ECB, which is a big conflict of interest.

“Given the ECB’s strategic focus on developing a CBDC, it is reasonable to infer that the authors, at best, have a vested interest in portraying Bitcoin as an inferior, speculative asset.”

The central bank also missed some important benefits of Bitcoin, such as its role in bringing people into the financial system and facilitating cross-border payments.

It can also be useful in countries where the currency is unstable, and it has led to technological advances in areas such as power grid stability and energy economy.