The crypto market has had a rough weekend, with Bitcoin price significantly falling following the release of US inflation figures last Friday.

Bitcoin (BTC) is trading 6.57 percent lower at $25,673, reaching an 18-month low, as of press time. Bitcoin has corrected more than 18% every week.

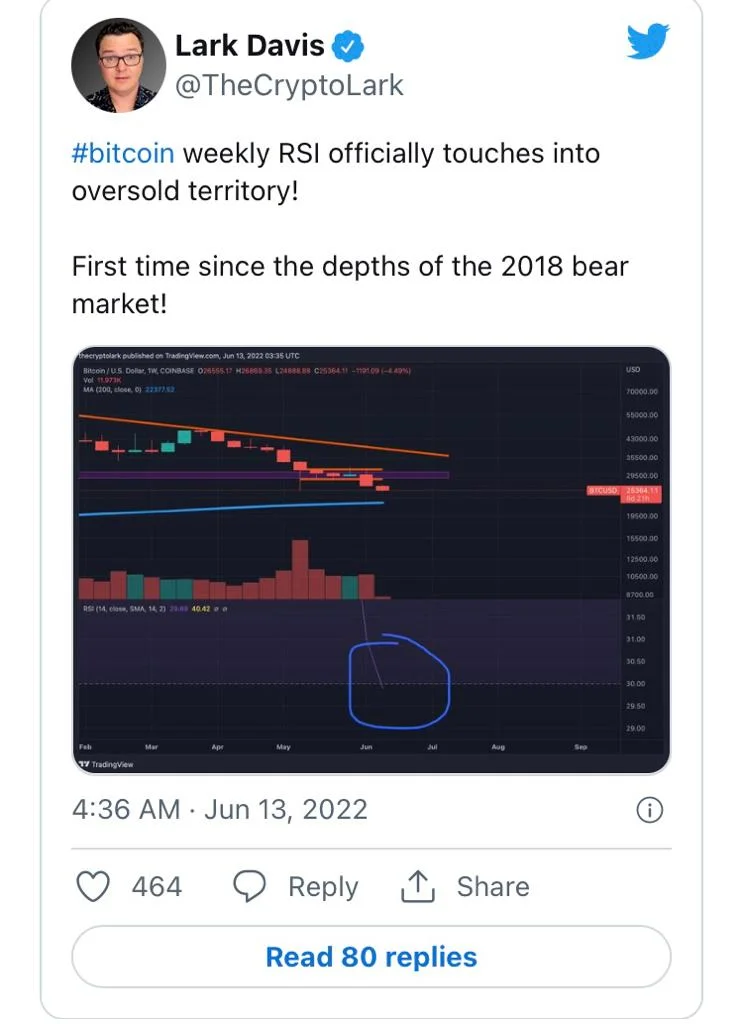

However, some technical indicators suggest that now is the time to add BTC, particularly for long-term holders. According to crypto analyst Lark Davis, Bitcoin’s relative strength index (RSI) has entered oversold territory for the first time since 2018.

Another interesting point Davis makes is that the volume in today’s BTC price crash to $25,000 has been very low. If buyers enter the market, we could see a reversal from here at any time. Unfortunately, buyer participation appears to be low right now.

Last Friday, just as the United States released its inflation figures, Bitcoin critic and gold advocate Peter Schiff predicted a sharp drop in BTC. He advises investors to avoid buying dips. Schiff wrote:

“This could be a rough weekend for #crypto. Bitcoin looks poised to crash to $20K and #Ethereum to $1K. If so, the entire market cap of nearly 20K digital tokens would sink below $800 billion, from nearly $3 trillion at its peak. Don’t buy this dip. You’ll lose a lot more money.”

What Bitcoin Investors Should Do

At this point, the cryptocurrency market is highly volatile and unpredictable. It has also corrected faster than the US equity market. With such high inflation in the United States, the Federal Reserve is likely to take swift action by raising interest rates.

However, this raises the prospect of the United States entering a recession. In this case, we could see another sell-off in US equities, putting pressure on crypto as well. Nexo’s co-founder and managing partner, Antoni Trenchev, stated:

“Cryptos remain at the mercy of the Fed and stuck in a merry dance with the Nasdaq and other risk assets. We’re hearing Bitcoin forecasts in the mid-teen and single-digit thousands which tells you the type of macro environment crypto is facing for the first time—and the levels of fear.”

However, some analysts believe that now is a good time to stack some more Sats, but with caution. Rick Bensignor, president of Bensignor Investment Strategies and a former Morgan Stanley strategist, stated:

“Typically, I’d suggest being a buyer here. But if you do get long, perhaps think about doing so with either a long call spread or a short put spread to limit risk. If this dives, there’s no reliable support nearby.”