According to a Bitcoin DeFi developer, the volume of capital allocated to Bitcoin-based decentralized finance (DeFi) protocols may surpass that of the Ethereum network within the next two years.

At Korea Blockchain Week, Branden Sedo, an initial contributor at Bitcoin sidechain Core DAO, informed Cointelegraph that the trillion dollars in capital presently held in the Bitcoin ecosystem will gradually begin to transition on-chain, ultimately displacing that of the Ethereum network.

“There is over one trillion dollars in Bitcoin,” he stated.

Sedo said that it would not be difficult to envision that a significant portion of this capital would be utilized in Bitcoin sidechains and other Bitcoin-based DeFi applications, assuming that Bitcoin will continue to appreciate in value and attract additional institutional capital through exchange-traded products (ETPs).

“It is feasible to anticipate a significant amount of that capital entering the chain, particularly in light of the forthcoming solutions such as trustless bridges and roll-ups.”

“It is a no-brainer to bring some of that liquidity on-chain and create more opportunities for Bitcoin,” he continued.

The approval of spot Bitcoin ETFs earlier this year brought Bitcoin scalability to the forefront, igniting a surge in market enthusiasm and development activity for Bitcoin sidechains such as Core, Bitlayer, and Stacks.

Flipping will necessitate a Change in the Behavior of Bitcoiners.

Nevertheless, Sedo stated that in order for Bitcoin’s DeFi TVL to overtake Ethereum’s, a greater number of Bitcoiners will need to become accustomed to the concept of utilizing their Bitcoin for productive purposes. This sentiment was exacerbated by the collapse of platforms such as BlockFi and Celsius in 2022.

Many Bitcoiners became avowedly opposed to any yield-bearing avenues for Bitcoin after losing Bitcoin in the collapse, refusing to do anything other than HODL their Bitcoin on a cold wallet.

“A lot of people have lost Bitcoin. I’ve lost Bitcoin. It’s not fun to lose Bitcoin. It fucking sucks. So there’s lots of understandable skepticism with these new things that come out.”

Nevertheless, Sedo has already observed a shift in the mindset of numerous Bitcoiners regarding the use of their cryptocurrency, particularly in the context of non-custodial DeFi applications.

Sedo reported that the general sentiment was one of amazement at the “explosion of what’s possible” on the Bitcoin network upon his return from the Bitcoin 2024 conference in Nashville, where the “vibe was very builder-centric.”

Sedo expressed his “highest level of confidence” in Core’s staking approach, which is entirely noncustodial. He also mentioned that Core’s bridge, which enables users to connect stablecoins and native CORE tokens, is powered by LayerZero, one of the few major bridging protocols in the crypto space that has not been subjected to a significant exploit.

In exchange for a 3% yield in CORE tokens, which are subsequently utilized for gas and network governance, users time lock their Bitcoin when utilizing Core Chain, eliminating the need to concern about custody or the transfer of private keys.

Bitlayer was recently acquired by Core, which has since become the largest Bitcoin sidechain with $314.4 million in TVL and 5,541 BTC staked on its network, which is equivalent to $321 million at current prices.

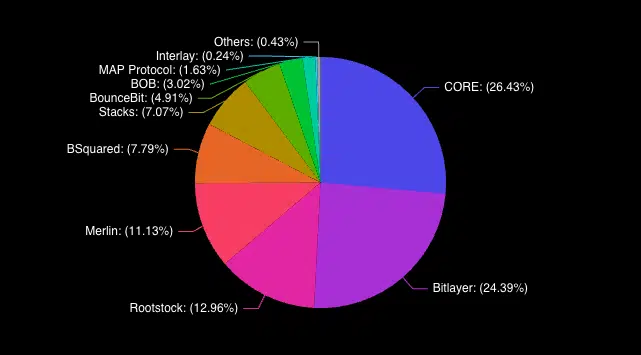

According to DeFiLlama data, Core makes up 26.4% of the total TVL across all Bitcoin sidechains at the time of publication.