The recent occurrence of misinformation coordinated by the SEC had a substantial influence on the volatility of Bitcoin (BTC), leading to an unexpected and peculiar sequence of events.

Extreme volatility characterized the Bitcoin price on Tuesday, January 9, in response to fake SEC approval news for Bitcoin ETF.

Following a significant increase to $48,000 on Tuesday, the price of Bitcoin has since returned to $46,000.

The SEC’s False News Causes BTC Volatility

The recent occurrence of misinformation coordinated by the SEC had a substantial influence on the volatility of Bitcoin (BTC), leading to an unexpected and peculiar sequence of events.

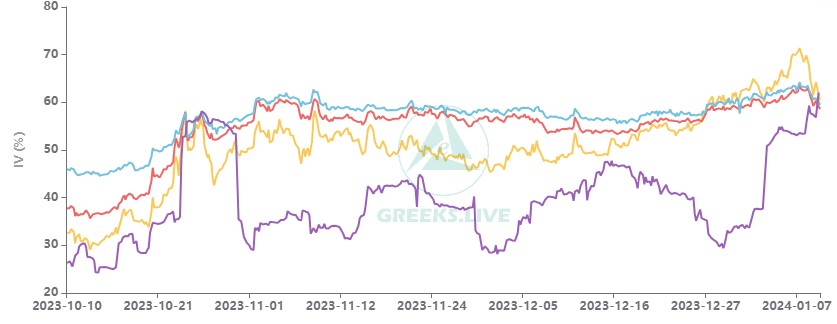

Unexpectedly, while the RV (Realized Volatility) increased significantly due to the unexpected volatility, the IV (Implied Volatility) decreased marginally.

Greeks.Live reports that the logic of this data deviates from the norm as a result of the ETF’s active trading for more than a month, during which a significant number of investors placed wagers on its performance, causing short-term IV to reach recent highs.

The SEC’s dissemination of inaccurate information had a twofold impact.

To begin with, it became clear to the vast majority of investors that the ETF had a restricted impact on BTC.

Additionally, this development intensified the market’s already fragile momentum, compelling numerous investors to implement deleveraging measures and scale back their holdings in an early “sell the news” approach.

Contradictory Signals in the BTC Market

FOMO sentiment has been enhanced by speculation regarding the imminent approval of a Bitcoin Exchange-Traded Fund (ETF), which caused Bitcoin to reach a new high of $47,000 during US trading hours.

However, the options market presents a mixed picture.

Short-term Implied Volatilities (IVs) underwent a substantial decline, with the current At-The-Money (ATM) option IV for June 11th falling below 90%, signifying a reduction of 30% within a matter of hours.

Additional options market terms exhibited significant declines as well.

Although prices reached all-time highs, block trades, a substantial component of market dynamics, remained comparatively subdued.

A breakout in which the market witnessed a dominance of selling calls and buying puts was evident.

Notably, concerns emerge regarding the future course of Bitcoin since institutional investors initiated short positions in the ETF market during its peak period.

Contradictory signals in the options market and block trades introduce a degree of unpredictability to the overall situation, compelling traders and investors to closely observe Bitcoin market developments.