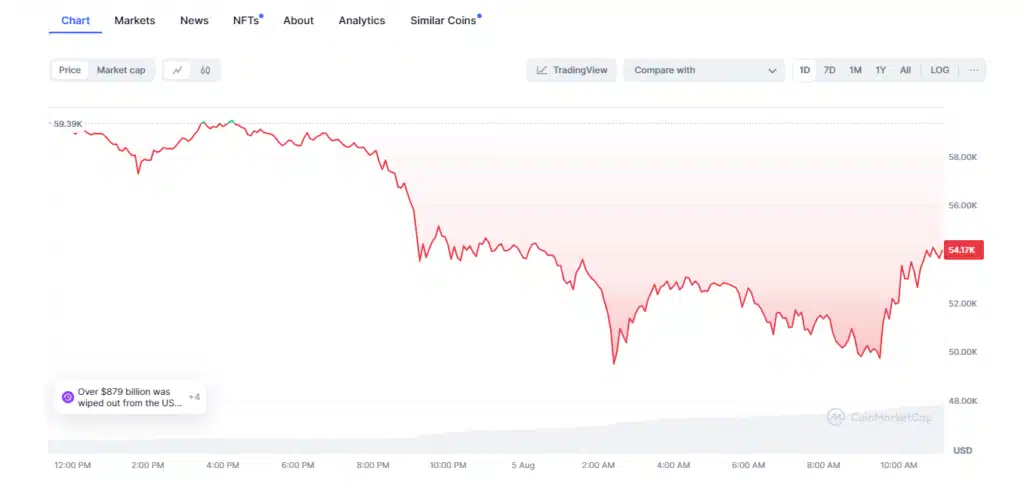

Due to the collapsing markets and an 8% decline in Bitcoin ETF prices, high trading activity of Bitcoin ETFs was responsible for this surge.

Alex Thorn, head of research at Galaxy Digital claimed in a post on the X platform that trading volumes for Bitcoin exchange-traded funds (ETFs) jumped beyond $1 billion at the start of trading on August 5.

Bitcoin ETF Racks Up $1.3 Billion Trading Volume

This was due to the fact that plummeting markets caused “extremely elevated” trading activity across the cryptocurrency market. According to the post, Bitcoin exchange-traded funds (ETFs) have already racked up more than $1.3 billion in trading volume after only twenty minutes of trading.

The iShares Bitcoin Trust has had the most churn, with upwards of $875 million. Investors are eager to take advantage of a drop in spot Bitcoin prices of approximately 8% since August 4th, and Thorn anticipates that Bitcoin ETFs will receive net inflows from “dip buying.”

QCP Group published a report on August 5 indicating that Ether was the primary driver of the decline. Ether experienced a decline of up to 21% after funds such as Jump Trading and Paradigm VC liquidated hundreds of millions of dollars’ worth of Ether, according to the research.

Analysts report that Jump has already sold over $377 million worth of Ethereum and the company may plan to liquidate as much as $481 million in total. Because of the overnight sell-off, the macro environment has become even more unstable, causing all asset classes to vibrate.

Since August 1st, the S&P 500 stock index has experienced a decline of more than 5%. The study reports that “poor data regarding unemployment in the United States last Friday also worsened macro sentiment.”

Additional factors that have contributed to the dramatic increase in volatility include massive unwinds across all assets.The Japanese central bank’s increase in interest rates on July 30 forced traders to immediately unwind bets meant to profit from Japan’s low cost of borrowing.

Markus Thielen, the founder of 10x Research, stated that he anticipates a slowdown in new cryptocurrency investments until the market stabilizes:

“The market structure, including fiat-to-crypto on-ramps, has been weak for months […] it’s unlikely that significant players will invest amid high volatility and unpredictable prices. Many still need to exit positions and deleverage their portfolios.”