On March 4, United States-based spot Bitcoin exchange-traded funds (ETFs) received $562 million in net inflows as the BTC price surpassed $68,000 and approached its all-time high of approximately $69,000.

Despite outflows from several minor participants and the Grayscale Bitcoin Trust (GBTC), inflows occurred on March 4. The day saw $368 million in outflows from GBTC.

Inflows were highest at $420 million for BlackRock’s iShares Bitcoin Trust and $404 million for Fidelity’s Wise Origin Bitcoin Trust. The daily net inflows into spot Bitcoin ETFs were ten times greater than the quantity of new BTC contributed to the supply via mining operations.

The total trading volume of Spot Bitcoin ETFs reached its maximum point of $5.5 billion on March 4, marking the second-highest volume day since the product’s introduction.

Due to institutional demand and the high trading volume, spot Bitcoin ETFs, exchange-traded products, and trackers now manage approximately 1 million BTC or 5.13 percent of the total BTC supply in circulation. K33 Research has published a report indicating that spot and futures ETFs in the United States manage approximately 83% of the 1 million BTC.

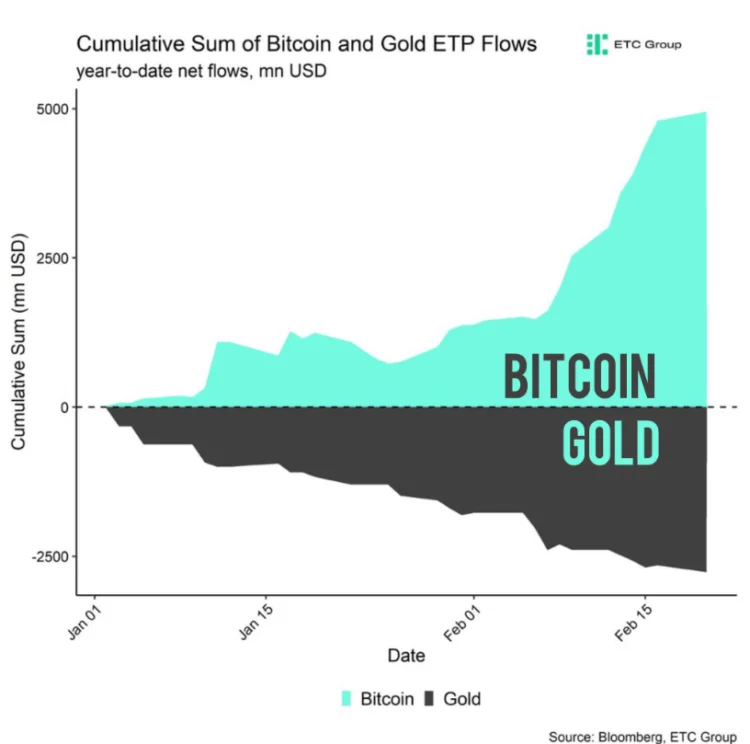

Despite outflows exceeding $9 billion, spot Bitcoin ETFs have experienced net inflows of $7.5 billion BTC in the two months since their inception. IBIT for BlackRock has already accumulated $10 billion in managed assets. Gold ETFs, on the other hand, required almost two years to attain that amount.

Due to BlackRock’s filing to acquire BTC for its Strategic Income Opportunities Fund, demand for Bitcoin ETFs may increase in the coming days. A catalyst for a further increase in the price of Bitcoin could be the April halving, which will reduce the daily supply of new BTC by half even though current market demand exceeds new supply by a factor of ten.