The Bitcoin and Ethereum price decline on August 18 caused the top two cryptocurrencies to fall to a two-month low, prompting thousands of derivative traders to liquidate their positions.

The crypto bloodbath resulted in liquidating hedged positions worth billions of dollars, and several traders lost millions of dollars in a single trade.

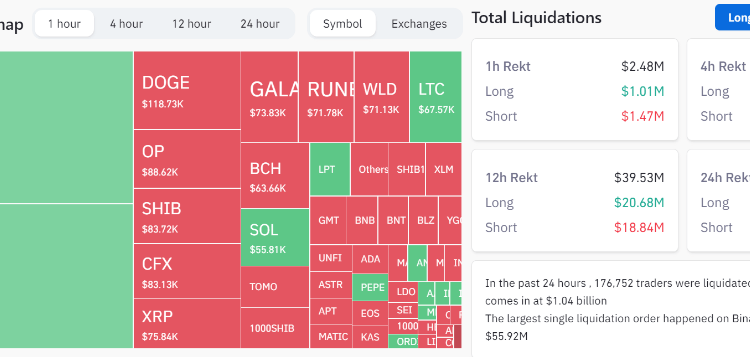

According to CoinGlass data, 176,752 traders were liquidated in the preceding twenty-four hours. 90% of these liquidations occurred within the last 12 hours, indicating a sharp increase in price volatility just days after BTC and ETH recorded their lowest daily volatility in years.

Among the sea of traders who lost a significant portion of their derivative positions, two liquidations caught the attention of the cryptocurrency community due to their sheer size.

During the price decline, an investor on Binance’s ETHBUSD contract was liquidated at $1,434.37, incurring a loss of $55.9211 million. This was the day’s most significant liquidation. Another Binance trader on the BTCUSDT contract lost nearly $10 million in liquidations.

The billion-dollar liquidation is the largest liquidation event in crypto over the past eight months, surpassing the FTX collapse as the largest event of its kind.

Several factors, including the SpaceX Bitcoin write-down and macroeconomics, where BTC and ETH have been trading in a range for the past few months, have been attributed to the price function of the cryptocurrency market.

BTC maintained the key $28,000 support for a couple of months, while ETH maintained the $1,500 support until August 17. The crypto market’s liquidity has been on the low side, and prominent crypto exchanges, such as Coinbase, have experienced a significant decline in trading volume.