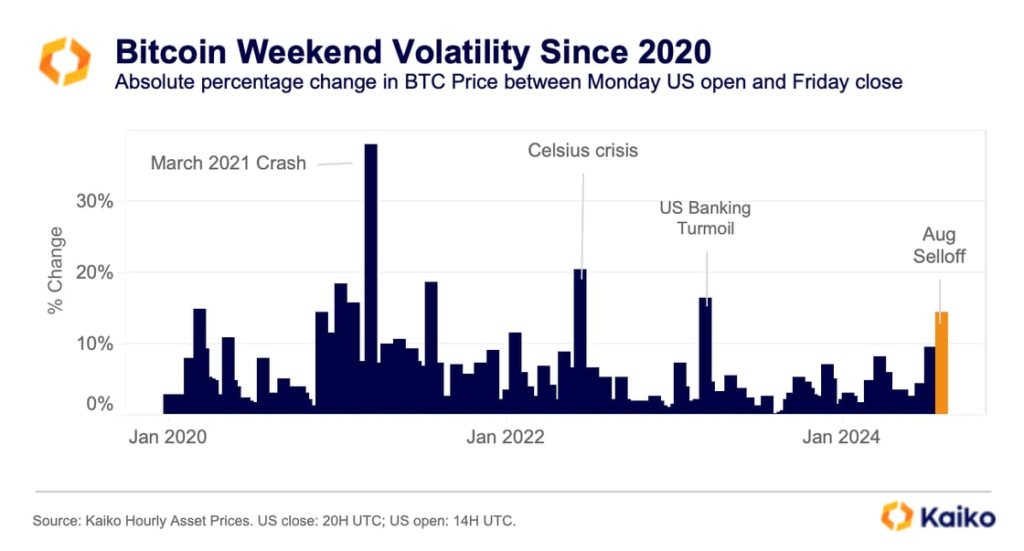

Bitcoin’s weekend volatility has increased due to spot ETF launches, as liquidity concentrates on weekdays, per Kaiko Research.

Since the introduction of spot Bitcoin exchange-traded funds (ETFs) in the United States, Bitcoin has become more susceptible to extreme weekend volatility, according to Kaiko Research.

Bitcoin’s liquidity has become increasingly concentrated on weekdays, particularly in BTC/US dollar markets, according to Kaiko’s crypto analysts in a report released on August 12.

It has previously reported that Bitcoin’s weekend trading volumes have decreased as institutional and ETF activity has increased, and it has observed that weekend trading volatility has generally decreased since 2021.

But the increased move to weekday Bitcoin trading “heightens the risk of sharp weekend price swings during market stress,” Kaiko wrote.

Kaiko observed “liquidity fragmentation” in the crypto markets during the most recent significant bitcoin sell-off on August 5, when it fell below $50,000. This resulted in price discrepancies across exchanges, particularly those that were smaller and less liquid.

It was observed that Bitcoin experienced a 14% decline between the close of the US market on Friday, Aug. 2, and its reopening on Monday, Aug. 5, during the sell-off, which was “similar to major sell-offs since 2020.”

“Unlike traditional markets that close on weekends, crypto markets operate 24/7. This causes sell-offs that start on a Friday to worsen weekend uncertainty, amplifying price impacts.”

In the interim, Kaiko stated that a $100,000 Bitcoin sell order during the Aug. 5 sell-off would have resulted in substantial price slippage, contingent upon the exchange and trading pair.

Zaif’s Bitcoin/yen pair experienced a slippage of up to 5.53%, while KuCoin’s BTC/euro pair reached nearly 5.5%. In the interim, BitMEX and Binance offer stablecoin pairs in the US dollar.Slippage in the United States reached as high as 4% on the day.

Since January, the 11 Bitcoin ETFs in the top ten positions in the United States have received $17.3 billion in net inflows. Currently, they possess approximately 4.7% of the Bitcoin supply, which provides them with a reasonable degree of control over the cryptocurrency’s liquidity.