Except for the US dollar, it’s optimistic all around after Fed Chair Jerome Powell’s latest address, with Bitcoin gaining $1,400 in less than an hour.

On August 26, Bitcoin (BTC) gained about $1,500 in less than an hour following Federal Reserve Chair Jerome Powell’s “uber dovish” statement.

Bitcoin’s price is surging upwards

Powell intimated at the virtual Jackson Hole annual conference that the Fed will begin to lessen its asset purchases that have been in place since the start of the Coronavirus pandemic.

The long-awaited signal, known as “tapering,” may occur this year, but Powell did not provide a clear start date.

“Even after our asset purchases end,” he continued, “our elevated holdings of longer-term securities will continue to support accommodative financial conditions.”

“The timing and pace of financial reduction of asset purchases will not be intended to carry a direct signal regarding the timing of interest rate lift-off, for which have articulated a different and substantially more stringent test.”

A slowdown in asset purchases would most likely take the wind out of the stock markets’ sails, and the Fed would be able to avoid index losses if Powell’s statements were followed by action. Following the speech, the S&P 500 continued to rise to new all-time highs.

Meanwhile, the United States dollar declined, as Bitcoin surged to new highs of more than $48,400 on Bitstamp, a popular digital currency exchange.

Traders and analysts were unanimously bullish on the stock market.

To conclude, Scott Melker stated that “Put on your rally hat, futures have expired and bitcoin is rising,” He also stated that the $2 billion end of month open interest expiry for open interest had been accomplished.

Meanwhile, popular Twitter trader Ryan Cantering Clark interpreted Powell’s tone as “uber dovish” and pushed for long positions in response to Powell’s comments.

Possibly the start of another bullish surge for Bitcoin

The bullishness for Bitcoin extended beyond the Federal Reserve and into the upcoming week.

The beginning of a new “bullish impulse” move, similar to the one that occurred at the end of July, according to analyst William Clemente, was signaled as early as Friday.

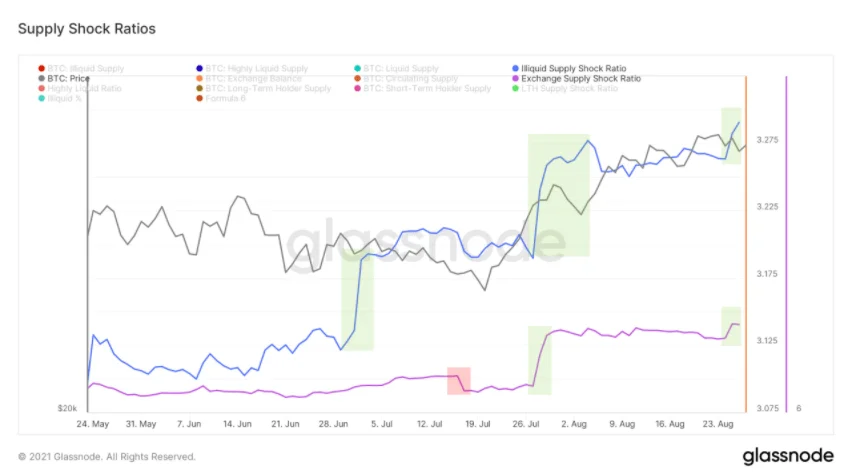

“After some profit-taking earlier in the week, it appears that we are starting another Bullish Impulse,” he said, pointing to many on-chain measures relating to Bitcoin’s “supply shock.” as evidence.

“Will need to monitor these flows over the next few days, but as of now leaning bullish for the coming 1-2 weeks.”

According to Cointelegraph, the conclusion on what will happen in the fourth quarter of this year remains firmly bullish.