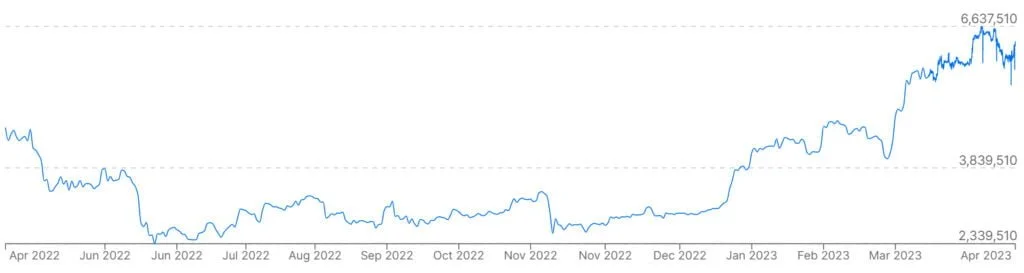

Bitcoin (BTC) has reached an all-time high price in Argentine pesos, as the local currency suffers from high inflation and capital controls.

The peso (ARS) has been dogged by inflation in recent years. This has intensified recently, with inflation now topping the 100% mark. BTC’s popularity, meanwhile, is on the rise in Argentina.

Currently, 1 BTC is trading for about ARS 6,331,980 on most international exchanges. By contrast, BTC is trading for just over $28,000 on April 26, down from highs of over $30,000 in mid-April.

Argentines turn to BTC and altcoins as USD buying is limited.

Argentines turn to BTC and altcoins as USD buying is limited

Due to caps on USD buying, many Argentines have turned to the BTC and altcoin markets. Similarly, some black market vendors sell USD bills at over double their spot market rates.

This situation has led some to believe that central bank reserves are starting to run dangerously low. In fact, many experts think reserves have halved since 2019.

Some citizens have taken to the streets in protest, claiming that the government’s monetary policy is to blame for the state of the peso. Protesters burned an effigy of the International Monetary Fund (IMF) at a recent march.

Presidential elections are slated for October this year. The ruling president, Alberto Fernandez, announced this month that he would not run for reelection.

The media outlet Criptonoticias wrote:

“The proximity of the elections […] is one of the factors that has led the [Argentine] population to dispose of the increasingly devalued Argentine peso on a massive scale.”

BTC vendors charge premium prices for fiat-to-crypto purchases

As a result of the spiking demand, some Argentine BTC vendors are asking for sky-high prices for fiat-to-crypto purchases.

For instance, the media outlet reported that “some brokers and exchanges” in the nation were charging prices of up to “ARS 13.5 million” (currently over $61,000) for BTC 1.