Bitcoin has suffered a significant drop in price in the last few weeks and which seems not to end soon, even as other assets are recovering from their price fall.

The recent losses of Bitcoin (BTC) have caused it to lag behind major U.S. equities this week.

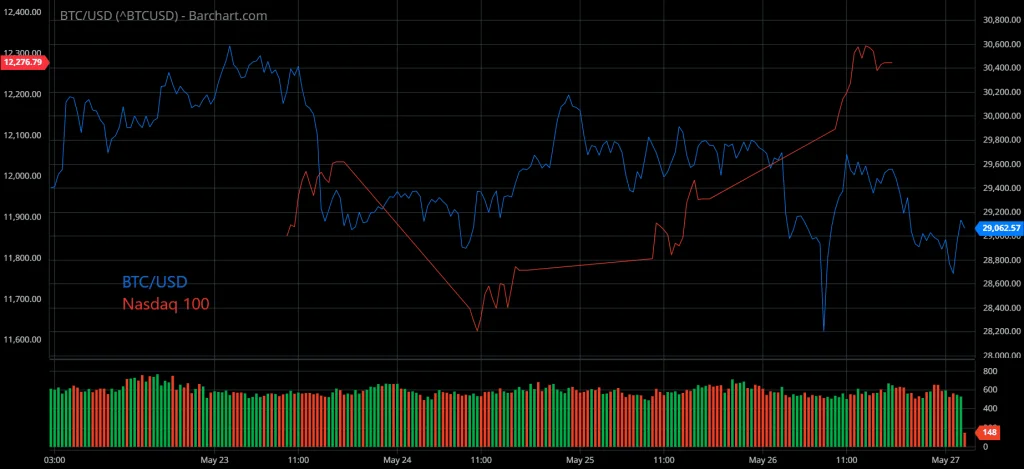

In the last seven days, the world’s largest cryptocurrency has dropped 4.5 percent to around $28,000. In comparison, the Nasdaq 100, BTC’s closest stock market counterpart, is expected to gain 2% this week.

The gap with the S&P 500 is even wider. This week, the benchmark index is up 3.3 percent.

While US stocks have recovered somewhat in recent days, Bitcoin has lagged. This was also evident in the token’s session on Thursday. Wall Street rallied despite weak GDP data from the United States, while Bitcoin fell below $29,000.

BTC is currently trading around $28,000, its last major support level, after which it may suffer even greater losses. Earlier this month, the token fell as low as USD 25,000.

With this week’s losses, the performance gap between BTC and the Nasdaq 100 this year has widened significantly.

BTC is now down nearly 40%, while the Nasdaq has recovered some of its losses and is now down about 25%. While Nasdaq has received some support from positive corporate earnings, Bitcoin has not.

The token is now on track for its ninth consecutive week in the red, its worst weekly run ever. The massive expiration of Bitcoin options on Friday may also result in further losses for the token.

On Friday, US stock futures are also trending lower.

BTC has fallen sharply this year, reversing the majority of its gains since 2021. These losses have been largely driven by concerns about rising inflation and interest rates.

These factors remain in play, severely dampening interest in cryptocurrencies. While BTC has fallen, altcoins have fallen even more dramatically.

The Terra crash has also contributed to this crypto aversion, with investors now anticipating a slew of new crypto regulations.

According to recent data, sentiment toward the cryptocurrency market is at its lowest point since the COVID crash in 2020.