Bitcoin experienced a significant bullish recovery late Sunday, May 22 after trading under $30,000 for nearly a week.

Bitcoin is currently trading 2.5% higher above its key resistance mark of $30,000 as of press time. Lark Davis, a well-known crypto expert, writes:

Bitcoin putting in a HUGE bullish divergence on the daily. The last time we had something like this happen was in 2021. Could this indicate a big rally brewing?

Davis goes on to say that, while the global macro environment is now worrying, there is some hope despite the bearish outlook. It will be fascinating to see if Bitcoin can turn this resistance zone into a strong support zone. Historically, $30,000 has been a critical level of support for Bitcoin.

Davis argues that given the lower highs and lower lows trendline, a relief rally up to $37,000 is possible. We may be approaching the 200-day moving average at this time. But this could mean that Bitcoin’s price falls to a low of $22,000 before making a clear breakout on the upside.

What if this is what happens for #bitcoin over the next couple months? pic.twitter.com/e9pw6gSiM3

— Lark Davis (@TheCryptoLark) May 23, 2022

On-chain Bitcoin Indicators Showing Strength?

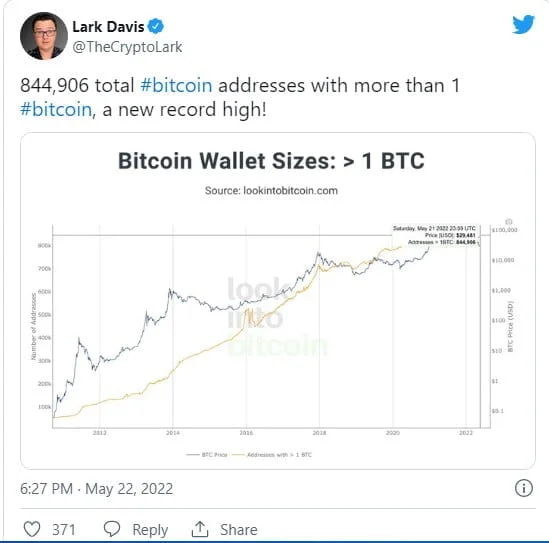

At a fundamental level, Bitcoin’s on-chain indicators continue to indicate strength. The number of Bitcoin addresses holding more than one bitcoin has reached a new all-time high moving closer to 1 million.

Whales have been doing some bottom fishing while the Bitcoin Fear and Greed Index remains in the high fear zone. According to Glassnode data, Bitcoin whale addresses with more than 10K BTC have been increasing during the recent market crash.

This indicates that the market’s weak hands have been leaving the market and passing over their supplies to the market’s big whales. One area of caution will be the rise in Bitcoin supply at exchanges. However, that has been a feature of every bear market. A bullish turnaround could be beneficial now that investors have had their fill of blood.