Bitcoin may hit $110K by January 2025, driven by rising global liquidity, before potentially dipping below $70K in February, says Raoul Pal.

Analysts predict that BTC will reach a local high of more than $110,000 before the month of January is up, indicating that the cryptocurrency has reached the “parabolic phase” of the market cycle.

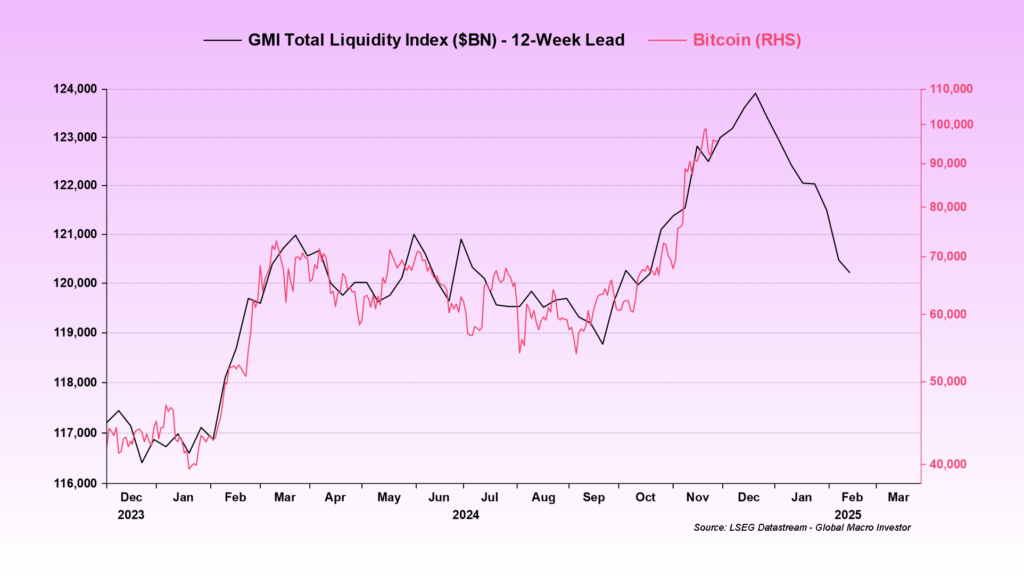

The association between the price of bitcoin and the Global Macro Investor’s Total Liquidity Index, which provides an aggregate view of the balance sheets of all of the major central banks, leads to the possibility that the price of bitcoin could soar above $110,000 by the end of January.

The price tag of $110,000 is merely a “local top” for the current Bitcoin cycle, as stated by Raoul Pal, the founder and CEO of Global Macro Investor, in a piece that was published on November 29 from X.

“There have been a lot of imitations of this chart going around with the wrong phasing. Here is the updated original from our work at Global Macro Investor.”

Assuming that the price of BTC follows the liquidity index, the right-hand side (RHS) of BTC, which represents the lowest bid price that someone is ready to sell the currency for, will reach its highest point near $110,000 in January 2025 before falling below $70,000 by February 2025.

Due to what Pal referred to as an “interim peak in liquidity,” which he anticipates will continue to rise until the third quarter of 2025, any potential drop below $70,000 will likely be brief.

“The increase in liquidity from the Fed typically enhances market conditions for risk assets like Bitcoin. Historically, such liquidity injections have led to increased investor interest and capital inflows into cryptocurrencies.”

Alvin Kan, chief operating officer of Bitget Wallet, believes that the ever-increasing money supply is a significant factor that has historically influenced the price of BTC. Several other analysts anticipate that the peak of global liquidity will occur around the end of January 2026.

It is possible that Bitcoin will be able to absorb up to ten percent of the newly generated money supply, according to existing historical data. Based on the anticipated rise in liquidity of $20 trillion, it is possible that this will lead to additional investments of $2 trillion into Bitcoin throughout 2025.

The cryptocurrency analyst Rekt Capital stated in a piece on November 29th, X, that BTC has “fully transitioned into the parabolic upside phase of the cycle,” based on the previously presented weekly chart.

Jamie Coutts, the chief crypto analyst at Real Vision, shared a chart suggesting that the price of Bitcoin could reach over $132,000 in the upcoming year.

“Longer term, this is where I am at for this cycle; a 12-month forecast based on linear relationship with liquidity. But Bitcoin cycles are not linear. I think we go much higher than this.”

In addition to the growing money supply, the price of Bitcoin received a significant boost from Donald Trump’s victory in the presidential election that took place on November 5th, 2018.Trump’s victory has inspired a fresh wave of risk appetite, expected to bolster the 2025 cryptocurrency rally.

“We expect all crypto assets to continue to make new highs into the new year once the Trump administration takes over and the industry benefits from an increasingly supportive regulatory environment.”

According to Adam Back, co-founder and CEO of Blockstream, the inventor of Hashcash and one of the most renowned cryptographers in the industry, Bitcoin might reach $1 million if the Trump government authorizes a potential strategic Bitcoin reserve.