The sharp fall in the price of Bitcoin (BTC) has reportedly initiated a major liquidation of the asset in the last three days.

Bitcoin, the world’s largest cryptocurrency, had yet another carnage this weekend, with the BTC price falling below $18,000 for the first time. There have been significant liquidations, with long-term Bitcoin holders throwing down the towel and abandoning up.

According to on-chain data provider Glassnode, Bitcoin liquidations of $2.42 billion have occurred every day for the last three days. According to the data provider:

“The last three consecutive days have been the largest USD denominated Realized Loss in Bitcoin history. Over $7.325B in $BTC losses have been locked in by investors spending coins that were accumulated at higher prices”.

Furthermore, over 555K Bitcoins have changed hands in the last three days in the $18,000-$23,000 price range. Long-term holders who had accumulated coins in H1 2021 or before began panicking, flooding the exchanges with 20K to 36K Bitcoins every single day.

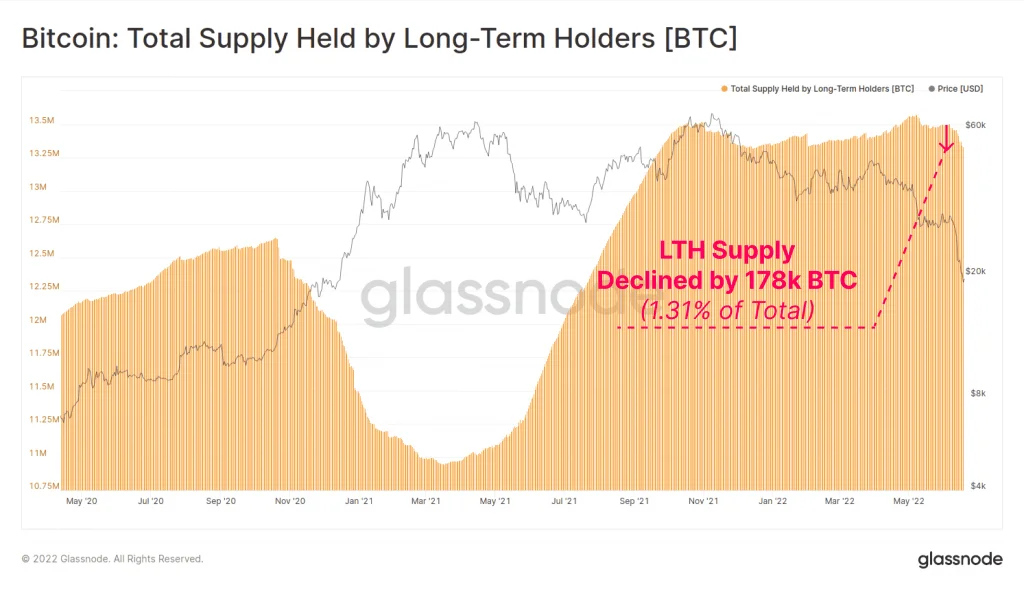

According to Glassnode data, long-term holders sold more than 178K Bitcoins after the price fell below $23,000. This accounts for 1.31 percent of their overall holdings. Furthermore, it raises the total LTH balance to September 2021 levels.

Glassnode also discusses indications of serious capitulation. It writes:

“Investigating the profit and loss by Long-Term Holders sending coins to exchanges, we can see a deep capitulation took place. A few #Bitcoin LTHs even bought the $69k top, and sold the $18k bottom, locking in -75% losses. Total LTH losses 0.0125% of Market Cap per day”.

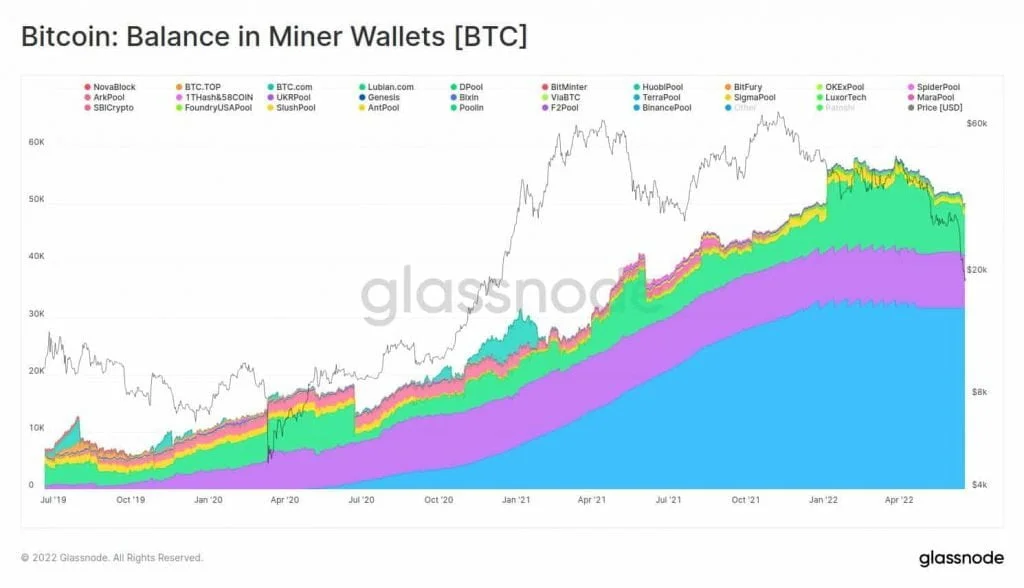

Furthermore, Glassnode stated that Bitcoin miners have been under pressure, with their balances stagnant since the 2019-2021 accumulation period. BTC miners spent $9,000 on their treasuries last week and still have more than 50,000 Bitcoins. Bitcoin hash rate has also fallen 10% from its all-time high.

Short-term investors have suffered significant losses in addition to long-term investors. “If we examine the damage, we can find that practically all wallet cohorts, from Shrimp to Whales, now contain significant unrealized losses, worse than March 2020,” Glassnode says.

According to the data provider, once the BTC price fell below $18,000, only 49 percent of all Bitcoins were profitable.