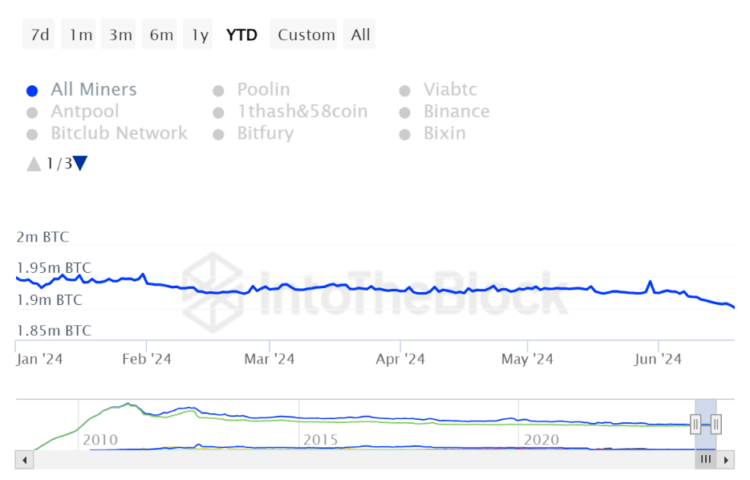

According to IntoTheBlock data, the Bitcoin miners‘ hold as reserves have experienced their lowest value in over 14 years since February 2010.

Miners’ reserves decreased to 1.90 million Bitcoin on June 19, following a peak of 1.95 million BTC at the beginning of the year.

Lucas Outumuro, the director of research at IntoTheBlock, anticipates that miners will maintain a reduced amount of Bitcoin in the future due to the halving of their margins, increasing their likelihood of selling their reserves.

The proof-of-work consensus mechanism of Bitcoin provides miners with new Bitcoin in exchange for validating transactions and securing the network. Miners’ reserves are the unclaimed virgin Bitcoin that they possess.

Miners receive a 50% reduction in their mining subsidies every four years.

On April 20, 2024, the most recent quadrennial halving occurred, decreasing mining rewards from 6.25 BTC to 3.125 BTC.

Outumuro told Cointelegraph, “Historically, this has occurred relatively slowly, so it has not been a significant selling pressure.”

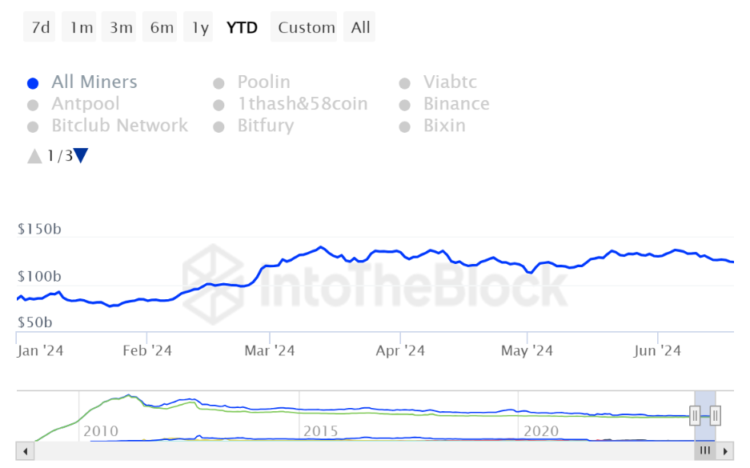

As measured in U.S. dollars, mining reserves have fluctuated within the all-time high range of approximately $135 billion despite the pay reduction. This implies that Bitcoin producers have a more excellent value in their dollar balance accounts, although they hold fewer Bitcoins.

Sascha Grumbach, CEO of tokenized mining firm Green Mining DAO, stated in a written commentary that today’s miners have acquired knowledge from previous cycles.

“Gone are the days of overleveraging and holding onto too much Bitcoin, a strategy that backfired in the past.”